Get Tax And Fee Reportingwashington State Liquor And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax And Fee Reporting Washington State Liquor And Wine Shipper to Consumer online

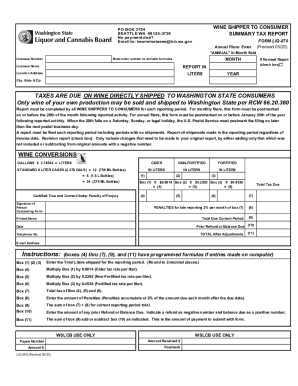

This guide provides clear instructions on how to complete the Tax And Fee Reporting Washington State Liquor And Wine Shipper to Consumer form online. Following these steps will help you accurately report your wine shipments and ensure compliance with state regulations.

Follow the steps to complete your reporting accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In the 'Month' field, enter 'ANNUAL' and specify your 'Licensee Number'. This must be accurately entered to activate formulas within the form.

- Provide your 'Licensee Name' and check the box if this is a revised report. Fill in the 'Location Address' along with the 'City, State & Zip' code.

- For the 'Year' field, indicate the applicable reporting year.

- Input the total liters of wine shipped during the reporting period in the appropriate boxes, rounding to two decimal places.

- Calculate the taxes due by multiplying the submitted liters in each category (Cider, Non-Fortified, Fortified) by their respective tax rates and record these values in the designated boxes.

- Add the calculated tax amounts from boxes (4), (5), and (6) to determine the total tax due in box (7).

- If applicable, enter any penalties for late reporting in box (8) at a rate of 2% per month.

- Calculate the current period total in box (9) by adding the amounts from box (7) and (8).

- Enter any prior refunds or balances due in box (10), marking refunds as negative numbers and balances due as positive.

- Finalize your calculations by adjusting the current period total in box (11) to reflect any prior values indicated in box (10).

- Once all information is accurately entered, save your changes, and prepare to submit the form via mail.

Complete your Tax And Fee Reporting Washington State Liquor And Wine Shipper to Consumer form online now to ensure timely compliance.

Related links form

Washington Wineries are required to submit form LIQ-774/777 WA Domestic Wine Summary Tax Report to the Board. Wineries with total taxable sales in Washington per calendar year in excess of 6,000 gallons must submit their report each month including months with no activity. Winery - Washington State Liquor and Cannabis Board wa.gov https://lcb.wa.gov › taxreporting › winery wa.gov https://lcb.wa.gov › taxreporting › winery

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.