Loading

Get Il 1040

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL 1040 online

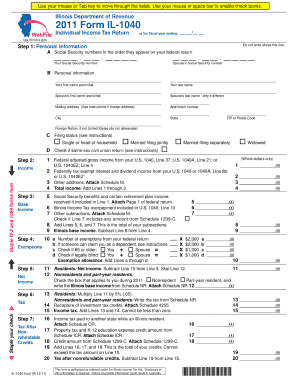

The IL 1040 is the Individual Income Tax Return form for residents of Illinois. Filling out this form online can streamline the tax filing process, making it easier to complete and submit your return while ensuring you receive your refund more quickly.

Follow the steps to complete your IL 1040 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your personal information, including Social Security numbers in the order they appear on your federal return. Enter your name, mailing address, and filing status. Make sure to include your spouse's information if applicable.

- Input your income details. Include your federal adjusted gross income and any other additions such as tax-exempt interest, and then calculate your total income by adding these lines together.

- Fill out your exemptions. Input the number of exemptions claimed on your federal return and any additional amounts based on age or blindness. Calculate your exemption allowance.

- Calculate your Illinois base income by subtracting your exemptions from your total income.

- Determine your tax amount by applying the appropriate tax rates to your base income. Include any applicable credits and adjustments from previous lines.

- Add up all your payments and refundable credits. If your total payments exceed your tax amount, you'll have an overpayment.

- Review your entries for accuracy and completeness, and then sign and date your tax return.

- If applicable, choose how you want to receive your refund, either by direct deposit or a paper check. Save your changes, download a copy of your completed form, and then print or share it as needed.

Start filling out your documents online today to ensure a smooth and efficient tax filing experience.

Your personal tax return is IRS Form 1040. A W-2 is a report by your employer (to you and to the IRS) of your wages which is to be attached to your personal return. So, yes, a W-2 is different from your personal tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.