Get How To Correct A 1099 After The Original Has Been Filed Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign How To Correct A 1099 After The Original Has Been Filed Form online

How to fill out and sign How To Correct A 1099 After The Original Has Been Filed Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The prep of lawful paperwork can be expensive and time-consuming. However, with our pre-built online templates, things get simpler. Now, using a How To Correct A 1099 After The Original Has Been Filed Form takes a maximum of 5 minutes. Our state-specific web-based blanks and crystal-clear instructions eradicate human-prone mistakes.

Follow our simple actions to have your How To Correct A 1099 After The Original Has Been Filed Form prepared quickly:

- Pick the web sample from the catalogue.

- Enter all necessary information in the necessary fillable areas. The intuitive drag&drop user interface allows you to include or move fields.

- Ensure everything is filled in appropriately, without any typos or absent blocks.

- Use your electronic signature to the page.

- Click on Done to confirm the adjustments.

- Save the papers or print out your copy.

- Submit instantly towards the recipient.

Take advantage of the fast search and innovative cloud editor to produce a precise How To Correct A 1099 After The Original Has Been Filed Form. Eliminate the routine and create papers on the internet!

How to edit How To Correct A 1099 After The Original Has Been Filed Form: customize forms online

Make the most of our powerful online document editor while preparing your forms. Complete the How To Correct A 1099 After The Original Has Been Filed Form, emphasize on the most important details, and easily make any other necessary adjustments to its content.

Preparing documents electronically is not only time-saving but also gives a possibility to alter the sample in accordance with your needs. If you’re about to work on How To Correct A 1099 After The Original Has Been Filed Form, consider completing it with our extensive online editing tools. Whether you make an error or enter the requested data into the wrong field, you can rapidly make adjustments to the document without the need to restart it from the beginning as during manual fill-out. Aside from that, you can point out the crucial information in your paperwork by highlighting certain pieces of content with colors, underlining them, or circling them.

Follow these quick and simple actions to fill out and edit your How To Correct A 1099 After The Original Has Been Filed Form online:

- Open the file in the editor.

- Type in the necessary information in the blank areas using Text, Check, and Cross tools.

- Adhere to the form navigation to avoid missing any essential areas in the sample.

- Circle some of the important details and add a URL to it if necessary.

- Use the Highlight or Line tools to stress on the most important pieces of content.

- Choose colors and thickness for these lines to make your sample look professional.

- Erase or blackout the data you don’t want to be visible to other people.

- Substitute pieces of content containing errors and type in text that you need.

- Finish modifcations with the Done option after you make certain everything is correct in the form.

Our robust online solutions are the best way to fill out and modify How To Correct A 1099 After The Original Has Been Filed Form in accordance with your needs. Use it to prepare personal or professional documents from anyplace. Open it in a browser, make any changes in your forms, and return to them at any moment in the future - they all will be securely kept in the cloud.

Related links form

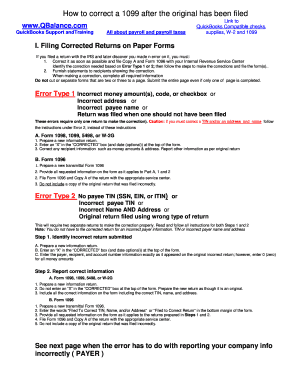

Type 2 Errors require two separate returns to make the correction properly. Errors on 1099 Tax Forms must be corrected as soon as possible. According to the IRS, most corrected forms must be filed by April 2, 2020 because March 31, 2020 falls on a Sunday.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.