Loading

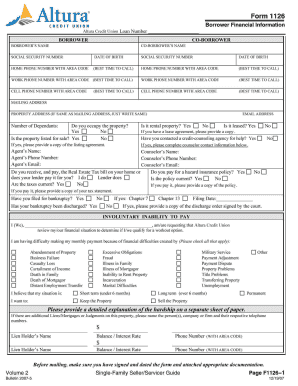

Get 'lg; Form 1126

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 'lg; Form 1126 online

Filling out the 'lg; Form 1126 online can be a straightforward process with the right guidance. This guide will walk you through each section and field of the form, providing detailed instructions to ensure that you complete it accurately.

Follow the steps to fill out the 'lg; Form 1126 online successfully.

- Click the ‘Get Form’ button to access the form and open it in the designated editor.

- Begin by entering your personal information in the appropriate fields. This typically includes your full name, address, and contact information. Ensure that all information is accurate and up to date.

- Next, proceed to fill out any sections that require specific details related to your request or application. Pay close attention to instructions provided within the form for clarity.

- After entering all required information, review the form for any errors or omissions. Double-check that all sections are completed as per the guidelines.

- Once you are satisfied that all information is correct, you can save your changes. Options may include downloading the completed form, printing a copy for your records, or sharing it as needed.

Start completing the 'lg; Form 1126 online today for a seamless submission experience.

A Part-Year Resident is an individual that has moved into or out of Missouri during the tax year. If one spouse is a resident and the other is not, you must file your state return using the same status as you filed your federal return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.