Loading

Get Dr 835 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dr 835 fillable form online

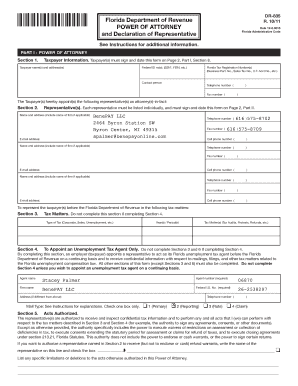

The Dr 835 fillable form is essential for establishing a power of attorney with the Florida Department of Revenue. This guide provides a clear and step-by-step approach to help users fill out the form online, ensuring that each section is completed accurately.

Follow the steps to fill out the Dr 835 form with ease.

- Click the ‘Get Form’ button to access the Dr 835 fillable form and open it in the online editor.

- In Part I, Section 1, provide the taxpayer information, including names, addresses, social security numbers or federal ID numbers, Florida tax registration numbers, and contact details.

- In Section 2, list the representative(s) including their names, addresses, and relevant contact information. Each representative must sign and date the form on Page 2.

- For Section 3, specify the tax matters and include the type of tax along with the relevant years or periods. It is critical to be specific about the tax matters.

- If appointing an unemployment tax agent, fill out Section 4 instead of Sections 3 and 6, entering the agent’s details as required.

- In Section 5, authorize the representative(s) for acts regarding the taxpayer's tax matters and specify any limitations.

- Section 6 allows you to choose how notices and communications will be sent, either to the first representative listed or directly to you.

- In Section 7, indicate if earlier powers of attorney should remain in effect or if a prior one should be revoked.

- Finally, Section 8 requires the signature of the taxpayer(s). Ensure it is signed and dated appropriately to validate the document.

- After completing the form, save the changes, then download, print, or share the form as necessary.

Complete your documents online today for a seamless filing experience.

Related links form

To request a tax refund, file an Application for Refund - Sales and Use Tax (Form DR-26S) or Application for Refund - All Other Taxes (Form DR-26). An application form may be completed to request moneys paid into the State Treasury for a tax overpayment, payment when tax was not due, or payment made in error.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.