Loading

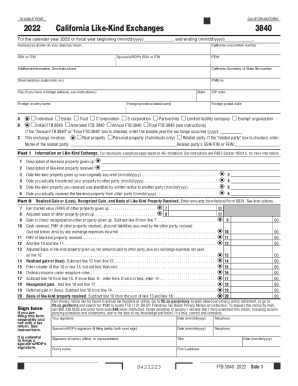

Get 2022 Form 3840 California Like-kind Exchanges. 2022 Form 3840 California Like-kind Exchanges

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2022 Form 3840 California Like-Kind Exchanges online

Filing the 2022 Form 3840 California Like-Kind Exchanges is essential for documenting property exchanges for tax purposes. This guide will provide clear, step-by-step instructions on how to accurately complete the form online, ensuring you meet all necessary requirements.

Follow the steps to successfully fill out the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your name and social security number (SSN) or individual taxpayer identification number (ITIN) as shown on your state tax return. If applicable, provide the name and SSN/ITIN of your spouse or registered domestic partner (RDP).

- Indicate your filing type by selecting one option from the boxes provided—options include Individual, Estate, Trust, C Corporation, S Corporation, Partnership, Limited Liability Company, or Exempt Organization.

- If applicable, check the boxes indicating if this is your initial, amended, annual, or final Form 3840.

- Detail the taxable year during which the exchange occurred, entering the year in the specified field.

- Specify whether the exchange involves real property, personal property, or if it is a related party transaction. If 'related party' is checked, provide the name and ID number of the related party.

- In Part I, provide information on the like-kind exchange, including descriptions of the property given up and received, acquisition dates, and transfer dates.

- Proceed to Part II, where you will calculate the realized gain or (loss), recognized gain, and basis of like-kind property received based on the instructions provided.

- Complete Schedule A with properties given up and properties received, ensuring to detail whether any properties are located in California, along with their respective details.

- Once all fields are filled, review your entries for accuracy before saving your changes, downloading, printing, or sharing the completed form.

Complete your Form 3840 online now to ensure compliance with California tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In California, a §1031 exchange allows you, as a real estate investor, to defer the federal and state income tax that would normally be incurred from selling real property, by using the proceeds of the sale to immediately purchase another 'like-kind' property.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.