Loading

Get Vat Declaration Form - Npower

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VAT Declaration Form - Npower online

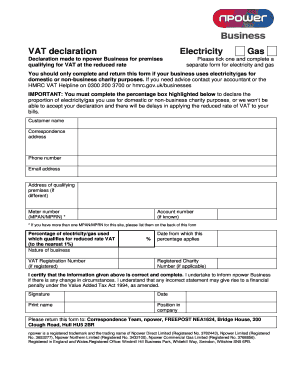

Filling out the VAT Declaration Form for Npower online is a straightforward process that ensures your business qualifies for the reduced rate of VAT on electricity and gas. This guide will walk you through each section of the form, providing clear instructions for completion.

Follow the steps to fill out the VAT Declaration Form accurately.

- Click the ‘Get Form’ button to access the VAT Declaration Form and open it in your chosen editor.

- Indicate whether you are completing this form for electricity or gas by ticking the appropriate box. Remember to fill out a separate form for each utility type.

- In the customer name field, enter the name of the person or business making the declaration.

- Provide your correspondence address along with your phone number and email address for any necessary communications.

- If the address of the premises qualifying for the reduced rate is different from your correspondence address, please fill that out in the specified field.

- Input the meter number (MPAN for electricity or MPRN for gas) in the designated space. If there are multiple meter numbers for your location, list them on the back of the form.

- If you know your account number, please include it in the field provided.

- Enter the percentage of electricity or gas used for domestic or non-business charity purposes, ensuring it's to the nearest percentage point. This percentage is vital for determining your eligibility for the reduced VAT rate.

- Below the percentage, detail the nature of your business and, if registered, provide your VAT registration number.

- Specify the date from which the declared percentage applies.

- If applicable, enter your registered charity number in the corresponding field.

- Certify the accuracy of the information by signing in the signature box and including the date. Print your name and include your position in the company if applicable.

- Once you have completed all sections, save your changes. You can then download, print, or share the form as needed.

Begin your VAT Declaration Form submission process online today!

A vendor must submit VAT returns and make payment (or claim a refund) of VAT on or before the 25th day or the last business day of the month (if registered for eFiling) following the month in which the vendor's tax period ends.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.