Loading

Get Mailfinance W 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mailfinance W 9 online

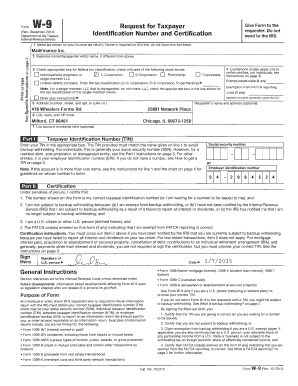

Filling out the Mailfinance W 9 form online is a straightforward process that can help ensure your taxpayer identification information is accurately submitted. This guide provides you with clear, step-by-step instructions to assist you in completing the form effectively.

Follow the steps to fill out the Mailfinance W 9 form accurately

- Press the ‘Get Form’ button to retrieve the Mailfinance W 9 form and open it in your chosen online editor.

- Enter your name as it appears on your income tax return in the first field. It is important to fill out this line completely without leaving it blank.

- If applicable, provide your business name or disregarded entity name in the second field. This is optional if it differs from your name in step 2.

- In the third section, select the appropriate box that identifies your federal tax classification. Choose only one option from the provided categories such as individual, corporation, or partnership.

- Input your mailing address, including the street number, apartment or suite number, city, state, and ZIP code in the appropriate fields.

- If applicable, provide any exempt payee code or exemptions from FATCA reporting in the specified section.

- In the next line, list any account numbers if relevant; otherwise, this step can be left blank.

- Enter your taxpayer identification number (TIN) in the dedicated field, which could be your social security number or employer identification number.

- Review the certification statement and confirm that all conditions are met. Make sure to cross out any items that do not apply.

- Finally, sign and date the form where indicated. Ensure that your signature is legible and fill in the date correctly.

- Once you complete the form, save your changes, and choose to download, print, or share the completed Mailfinance W 9 as necessary.

Complete your Mailfinance W 9 form online today and ensure your information is accurately submitted.

Exemptions This section of the W-9 tax form applies only to certain entities, not to individuals. ... Nonresidents do often complete W-9 to tell the requester that they are exempt from withholding due to treaty or other payments that are exempt from federal withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.