Loading

Get Advanta Payment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Advanta Payment Form online

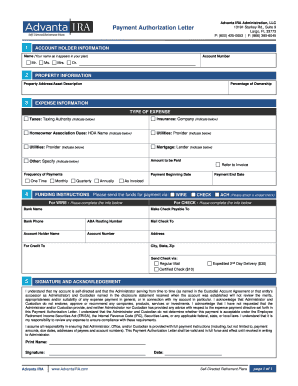

Filling out the Advanta Payment Form online is a straightforward process that allows users to authorize payments for expenses related to their investment accounts. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Advanta Payment Form online

- Click the ‘Get Form’ button to access the Advanta Payment Form and open it in your designated editor.

- Begin by filling out the account holder information section. Enter your name as it appears in your investment plan and provide your account number.

- In the property information section, input the property address or a description of the asset you are referencing in the form, along with the percentage of ownership.

- Next, move on to the expense information. Specify the type of expense you are authorizing payment for by checking the appropriate category, such as taxes, insurance, homeowner association dues, or utilities. Provide the necessary details as requested, including the name of the taxing authority or insurance company.

- Indicate the amount to be paid and select the frequency of payments, choosing from options such as one-time, monthly, quarterly, or annually. Clearly specify the payment beginning date.

- For funding instructions, specify whether you wish to send the funds via wire transfer, check, or ACH by completing the relevant information. For wire transfers, provide the bank name and information needed for the transfer. If choosing to pay by check, make sure to fill in the payee's details and where to mail the check.

- Once you have completed all required fields, review the signature and acknowledgment section. You must read the statement to understand your responsibilities and the role of the administrator and custodian regarding the expense payment.

- Finally, print your name, provide your signature, and include the date of completion. Once the form is filled out, you can save changes, download it for your records, print a physical copy, or share it as necessary.

Complete your Advanta Payment Form online today to ensure your payments are processed efficiently.

Related links form

Pros include asset control, better diversification, and potentially high ROI. Cons include liquidity concerns, time commitment, and loss of property tax benefits. For any real estate investment, calculating the various profit scenarios will help determine the best Self Directed IRA path.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.