Loading

Get Ph Bir 1801 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1801 online

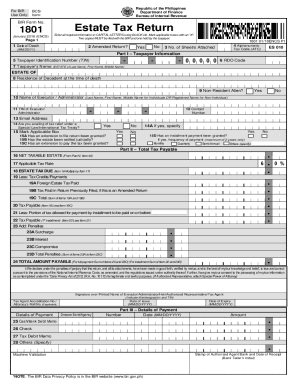

Filing the PH BIR 1801, or Estate Tax Return, online can streamline the process of reporting the estate of a deceased person. This guide provides step-by-step instructions to help you confidently complete the form while ensuring accuracy and compliance with tax regulations.

Follow the steps to successfully complete the PH BIR 1801 online.

- Click the ‘Get Form’ button to obtain the estate tax return and open it for editing.

- Enter the date of death in the format MM/DD/YY and indicate if this is an amended return by marking the applicable box.

- Specify the number of sheets attached and enter the Tax Code (ATC) required for your return.

- Complete Part I by entering your Taxpayer Identification Number (TIN), the RDO Code, the estate name in the format 'ESTATE OF Last Name, First Name, Middle Name,' and the residence of the decedent at the time of death.

- Indicate whether the decedent was a non-resident alien by marking the appropriate box.

- Provide the name and TIN of the executor or administrator, and include their contact number and email address.

- Address tax relief options under special laws or international tax treaties by indicating if applicable, and specifying if an installment payment has been granted.

- In Part II, calculate the total tax payable by first determining the net taxable estate, applicable tax rate, and estate tax due.

- List any tax credits or payments that will reduce your tax payable, ensuring to include any tax already paid in previous returns if this is an amended return.

- Complete any penalties that may apply, followed by calculating the total amount payable based on all previous entries.

- Review all information for accuracy and completeness, as the return and all attachments must be declared true and correct.

- After filling in all sections, save your changes, and opt to download, print, or share the completed form as needed.

Start filling out your PH BIR 1801 online today to ensure compliance and timely submission.

Related links form

If the decedent has no legal residence in the Philippines, the return shall be filed with RDO No. 39-South, Quezon City.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.