Loading

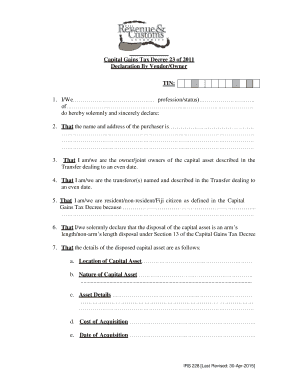

Get Cgt Statutory Declaration Irs228 - Frca Org

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CGT Statutory Declaration IRS228 - Frca Org online

Filling out the CGT Statutory Declaration IRS228 is an essential process for individuals involved in capital asset transactions. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your declaration effectively.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering your Tax Identification Number (TIN) in the designated field.

- Fill in your name and profession/status in the specified sections.

- Provide your address in the appropriate field.

- Enter the name and address of the purchaser in the relevant areas.

- Describe your ownership status regarding the capital asset being transferred.

- Indicate whether you are a resident, non-resident, or Fiji citizen, and specify the reason.

- Choose between an arm's length or non-arm’s length disposal, referencing Section 13 of the Capital Gains Tax Decree.

- Detail the disposed capital asset by providing information such as its location, nature, and asset details.

- Include the cost of acquisition and date of acquisition in the corresponding fields.

- State the purpose of acquisition, including any structural improvements made before and after purchase.

- Complete the consideration on disposal and specify portions of the asset not used as the principal residence.

- Claim any exemptions or deferrals under the relevant sections of the Capital Gains Tax Decree.

- Provide the name and address of the real estate agent, along with any commission paid.

- Review all entries for accuracy, then save your changes, download, print, or share the completed form as required.

Complete your CGT Statutory Declaration IRS228 online today for a seamless filing experience.

Documents Required to File ITR-2 Form Aadhaar Card. PAN (Permanent Account Number) TDS certificates / Form 26AS. Form 16 if you are a salaried Individual. AIS/TIS statement from Income tax portal. Challan of the paid taxes. Bank account details. Original return details (if you are filing for a revised return)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.