Loading

Get Section 125 Plan Document Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 125 Plan Document Requirements online

This guide provides a clear and supportive approach to completing the Section 125 Plan Document Requirements online. Users will be guided through each section to ensure accurate and effective filling of the necessary information.

Follow the steps to complete the form accurately and effectively.

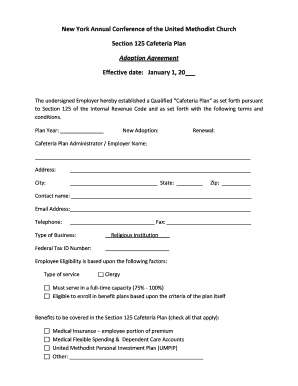

- Press the ‘Get Form’ button to obtain the Section 125 Plan Document Requirements. This will allow you to access the form for completion.

- Fill in the plan year by entering the relevant year in the space provided.

- Indicate whether this is a new adoption or a renewal by checking the appropriate box.

- Enter the Cafeteria Plan Administrator or Employer name in the designated field.

- Provide the address, including city, state, and zip code in the corresponding sections.

- Input the contact name, email address, telephone number, and fax number for the plan administrator.

- Specify the type of business by checking the box for 'Religious Institution'.

- Enter the Federal Tax ID Number in the appropriate section.

- Outline employee eligibility by checking the relevant criteria, noting that eligibility is based on type of service and capacity.

- Select all applicable benefits to be covered in the Section 125 Cafeteria Plan by checking the boxes next to each benefit.

- Detail the eligibility requirements for employees by checking the relevant factors and providing any additional information as necessary.

- Print the name of the signatory, their title, and obtain their signature in the designated spaces.

- Insert the church name and the date of signing.

- Once all required sections are filled out, users can save changes, download, print, or share the completed form as needed.

Complete your Section 125 Plan Document Requirements online today.

A Section 125 plan typically lets employees use pretax money to pay for health insurance premiums (medical, dental, vision). Other options include retirement deposits, supplemental life or disability insurance, Health Savings Accounts, and various medical or dependent care expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.