Loading

Get Ar8453 Ol 2019 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar8453 Ol 2019 form online

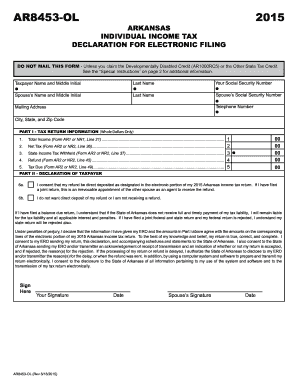

The Ar8453 Ol 2019 form is essential for declaring your Arkansas individual income tax when filing electronically. Understanding each section will guide you in providing accurate information, ensuring a smooth filing process.

Follow the steps to complete the Ar8453 Ol 2019 form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- Begin by entering your name and middle initial in the designated fields, followed by your last name and social security number. Ensure this information matches your tax return.

- Next, fill in your spouse's name and middle initial, last name, and social security number if applicable. This section should reflect exactly as it appears on the joint return.

- Provide your telephone number along with your mailing address, including city, state, and zip code to facilitate communication regarding your return.

- In Part I, enter the total income from Form AR1 or NR1 on Line 1, followed by the net tax on Line 2 from Form AR2 or NR2. Continue this for lines 3, 4, and 5 using the respective forms to complete sections accurately.

- For Part II, you will need to declare your preference for refund deposit. Mark Line 6a if you wish to have your refund directly deposited and provide the account information as designated. If not, mark Line 6b.

- Review your entries to ensure accuracy, sign and date the form where indicated. If a joint return was filed, your spouse must also provide their signature and date.

- After completing the form, you may save changes, download, or print the form for your records. Ensure you keep the signed AR8453-OL along with your tax return and any necessary attachments.

Complete your documents online today to ensure a timely and accurate filing experience!

The AR4EC Employee's Withholding Exemption Certificate must be completed by employees so employers know how much state income tax to withhold from wages. This form should be provided to employees at time of hire or upon request and should be maintained in conjunction with the federal Form W-4.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.