Loading

Get Community Volunteer Income Tax Program Authorization

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Community Volunteer Income Tax Program Authorization online

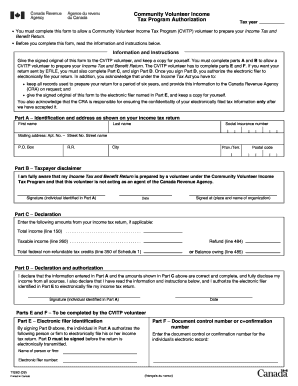

Filling out the Community Volunteer Income Tax Program Authorization is an important step in allowing a designated volunteer to prepare your income tax and benefit return. This guide will provide you with clear and comprehensive instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, enter your identification and address details as stated on your income tax return. This includes your first name, last name, social insurance number, mailing address, city, province/territory, and postal code.

- For Part B, review the taxpayer disclaimer statement. Confirm that you understand your income tax return is prepared by a volunteer who is not acting as an agent of the Canada Revenue Agency. Provide your signature, indicate the place and name of the organization where you are signing, and enter the date.

- Proceed to Part C to declare relevant income amounts from your tax return. You will need to enter your total income, taxable income, refund amount, and total federal non-refundable tax credits, or balance owing.

- In Part D, validate and sign the declaration. Confirm that the information from Part A and the amounts shown in Part C are accurate and complete. Add your signature and the date.

- Parts E and F are to be completed by the CVITP volunteer. They will need to enter their identification details and the document control or confirmation number for the electronic record.

- After reviewing all sections for accuracy, save your changes, and you may choose to download, print, or share the completed form.

Take the next step in your tax preparation by completing the Community Volunteer Income Tax Program Authorization form online today.

.VITATaxesFree.org - FREE tax preparation across Broward County for individuals and families who earned less than $54,000 last year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.