Loading

Get 72t Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 72t Form online

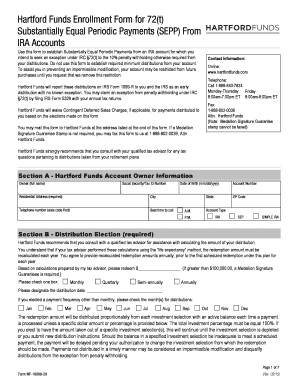

The 72t Form is an important document for individuals seeking to establish Substantially Equal Periodic Payments from their IRA accounts under IRC §72(t). This guide will provide clear and supportive instructions on how to fill out the form online effectively.

Follow the steps to complete the 72t Form online.

- Click ‘Get Form’ button to download the form and access it for completion.

- In Section A, provide your full name, Social Security or Tax ID Number, residential address, city, and state, telephone number, and date of birth.

- Complete Section B by calculating the amount of your distribution as directed and select your desired payment frequency (monthly, quarterly, semi-annually, or annually). Designate your distribution date and ensure the total investment percentage equals 100%.

- In Section C, choose your preference for federal income tax withholding. Provide additional state income tax withholding instructions if applicable, and acknowledge the tax information stated.

- In Section D, select where your payments should be delivered. You can choose to have checks sent to your current address or an alternate address or deposit the funds directly into your bank account via ACH.

- Finally, in Section E, sign and date the form. Ensure to obtain a Medallion Signature Guarantee Stamp if required, and review all sections to ensure accuracy before submission.

Complete your 72t Form online today to streamline your IRA payment process.

You may begin at any age under 59 ½. However, you must set up a schedule of substantially equal payments (paid at least annually) that is calculated in ance with IRS requirements and is based on your life or life expectancy (or the joint life or life expectancy of you and your beneficiary).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.