Loading

Get Request For Refund Of Duty On Registration Of Replacement Motor - Osr Nsw Gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Refund Of Duty On Registration Of Replacement Motor - Osr Nsw Gov online

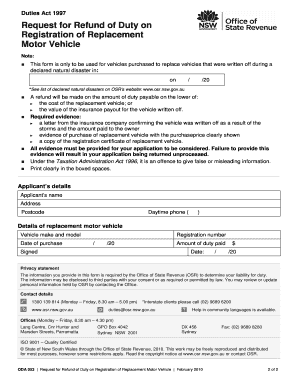

This guide provides a comprehensive overview of how to properly fill out the Request for Refund of Duty on Registration of Replacement Motor form. By following these steps, users can ensure that their application is submitted correctly and efficiently.

Follow the steps to complete your refund request form online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by filling in the applicant’s details. Provide your full name, address, and postcode accurately.

- Enter your daytime phone number in the designated space to ensure the Office of State Revenue can reach you for any inquiries.

- In the section for details of the replacement motor vehicle, input the vehicle's make and model, along with the date of purchase.

- Fill in the registration number of the replacement vehicle and the amount of duty paid.

- Make sure to sign and date the form at the designated areas to validate your application.

- Prepare the required evidence documents: a letter from your insurance company, proof of purchase for the replacement vehicle, and a copy of the registration certificate of the replacement vehicle.

- Once all sections of the form are complete and you have gathered the necessary documents, you can submit your application. Choose to post to the Office of State Revenue, fax it, or deliver it in person as indicated.

- You may then save changes, download, print, or share the completed form as needed.

Complete your Request for Refund Of Duty On Registration Of Replacement Motor online to ensure a smooth application process.

The amount of tax due is usually based on the home's assessed value. ... But if the taxes aren't collected and paid through escrow, the homeowner must pay them on his or her own. When the homeowner doesn't pay the property taxes, the delinquent amount becomes a lien on the home.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.