Loading

Get Sample Profit And Loss Statement Pdf - Chase

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Sample Profit And Loss Statement PDF - Chase online

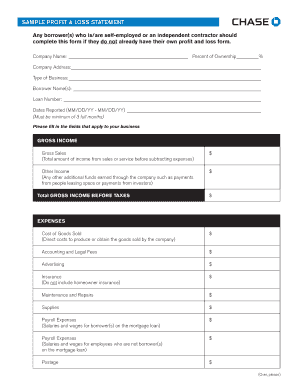

This guide provides a detailed overview of how to accurately fill out the Sample Profit And Loss Statement PDF from Chase. By following these instructions, users can ensure that they provide the necessary financial information in a clear and organized manner.

Follow the steps to complete your profit and loss statement online.

- Click 'Get Form' button to access the Sample Profit And Loss Statement PDF - Chase and open it for editing.

- In the section labeled 'Company Name,' enter the complete legal name of your business.

- Next, indicate your 'Percent of Ownership' in the business, providing a numerical value.

- Fill in the 'Company Address' with the physical location of your business.

- Select the 'Type of Business' from the provided options or describe it briefly.

- Under 'Borrower Name(s),' input your name or the names of the individuals responsible for the form.

- Document the 'Loan Number' associated with the business loan.

- For 'Dates Reported,' enter the start and end date in MM/DD/YY format. Ensure the period covers a minimum of three full months.

- In the 'GROSS INCOME' section, fill in 'Gross Sales' reflecting total income before expenses.

- Enter any 'Other Income' your business earns apart from sales, such as lease payments.

- Calculate 'Total GROSS INCOME BEFORE TAXES' by summing 'Gross Sales' and 'Other Income'.

- Proceed to the 'EXPENSES' section. Start by entering 'Cost of Goods Sold,' representing direct production costs.

- Input relevant figures for 'Accounting and Legal Fees,' 'Advertising,' and 'Insurance,' ensuring they do not include any homeowner insurance.

- Continue with 'Maintenance and Repairs,' 'Supplies,' and 'Payroll Expenses' for owners and additional employees.

- Complete the remaining expense categories including 'Postage,' 'Rent,' 'Licenses,' 'Taxes,' 'Telephone,' 'Travel/Transportation,' and 'Utilities.'

- Include any 'Other' expenses not listed previously, providing detailed descriptions when necessary.

- Sum up all entered amounts to present the 'Total EXPENSES' value.

- In the 'NET INCOME' section, calculate 'Net Income Before Taxes' by subtracting 'Total EXPENSES' from 'Total GROSS INCOME BEFORE TAXES.'

- Enter any applicable 'Taxes' paid on business income to finalize the section.

- Calculate 'Total NET INCOME AFTER TAXES' by subtracting the entered taxes from 'Net Income Before Taxes.'

- Lastly, review all the information for accuracy, sign where indicated, and date the document.

Complete your Sample Profit And Loss Statement online for quick processing.

Related links form

First, show your business net income (usually titled "Sales") for each quarter of the year. ... Then, itemize your business expenses for each quarter. ... Then show the difference between Sales and Expenses as Earnings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.