Loading

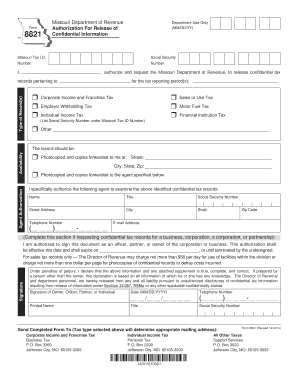

Get Form 8821 - Authorization For Release Of Confidential Information

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8821 - Authorization For Release Of Confidential Information online

Filling out the Form 8821 is an essential step for individuals or businesses seeking to authorize the Missouri Department of Revenue to release confidential tax information. This guide provides clear instructions to help users complete the form online effectively.

Follow the steps to fill out the Form 8821 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, input your full name in the designated field. This identifies you as the individual granting the authorization.

- Provide your Missouri Tax Identification Number and Social Security Number in the corresponding fields. Ensure that these numbers are accurate for proper identification.

- Next, specify the type of record you want the department to release by checking the boxes for each applicable tax category, including Corporate Income Tax, Individual Income Tax, or any other relevant category.

- Indicate the tax reporting period for which you are requesting records. Ensure to select the correct period to avoid delays.

- Decide how you want the records to be delivered. You can choose to have them photocopied and sent to your address by providing complete details, or sent to a specified agent by completing the agent authorization section.

- In the 'Agent Authorization' section, input the agent's full name, title, address, and contact information. This authorizes them to access the records on your behalf.

- If the request is for a business entity, confirm your authority to sign by marking the appropriate box and signing the form to validate your request.

- Date the form by entering the current date in the specified format of MM/DD/YYYY.

- Finally, ensure all fields are complete and accurate before saving your changes. Once finalized, you can download, print, or share the form as needed.

Complete your documents online for a seamless filing experience.

If you are submitting Form 8821 to authorize disclosure of your confidential tax information for a purpose other than addressing or resolving a tax matter with the IRS (for example, for income verification required by a lender), the IRS must receive the Form 8821 within 120 days of the taxpayer's signature date on the ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.