Loading

Get Fp 100 Homestead Deduction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fp 100 Homestead Deduction Form online

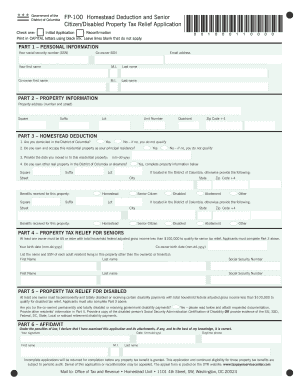

Filling out the Fp 100 Homestead Deduction Form online is an essential step for qualifying for property tax benefits in the District of Columbia. This guide will take you through each section of the form, ensuring you provide the necessary information for a successful application.

Follow the steps to complete the Fp 100 Homestead Deduction Form online.

- Click 'Get Form' button to obtain the form and open it in your editor.

- In Part 1, enter your personal information. This includes your social security number, email address, and your first and last name. If applicable, also provide the co-owner's information.

- Move to Part 2 and fill out the property information. Input the property address, including the number and street, square, suffix, lot, unit number, quadrant, and zip code +4.

- Proceed to Part 3, the Homestead Deduction section. Answer all questions: confirm if you are domiciled in Washington, D.C., if you own and occupy the property as your principal residence, and provide the date you moved in. If relevant, disclose if you own any other real property.

- In Part 4, if applicable, provide information for property tax relief for seniors. Confirm the co-owner's and your birth dates, and list the names and social security numbers of any adult residents living in the property.

- If either you or the co-owner is permanently disabled, complete Part 5, providing evidence of the disability and other required resident information.

- Finally, complete Part 6, the Affidavit section. Sign and date the form, including your first name, middle initial, last name, and daytime phone number. Ensure all information is accurate to avoid penalties associated with false information.

- After completing the form, save any changes. You can then download, print, or share the completed form as needed.

Take action today by filling out the Fp 100 Homestead Deduction Form online.

Taxpayers who meet one of the following requirements as of December 31 of the year before the taxes are due: At least 61 years of age or older. Retired from regular gainful employment due to a disability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.