Loading

Get Income-tax Rules 1962 Form No 3cefb See Sub-rule 1 Of - Webtel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the INCOME-TAX RULES 1962 Form No 3CEFB online

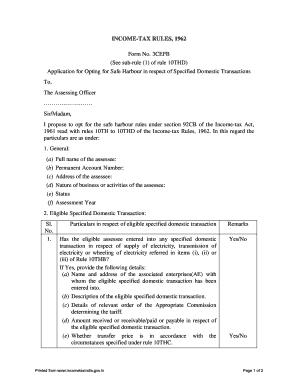

This guide offers a clear and comprehensive approach to filling out the INCOME-TAX RULES 1962 Form No 3CEFB, which is essential for opting for safe harbour in specified domestic transactions. By following these steps, users can easily navigate the form and ensure accurate submissions.

Follow the steps to effectively fill out the form.

- To obtain the form, click the ‘Get Form’ button to open it in your preferred editor.

- Begin filling in the general details. Enter the full name of the user, their permanent account number (PAN), and the complete address.

- Provide information about the nature of the business or activities conducted by the user, as well as their current status and the relevant assessment year.

- For eligible specified domestic transactions, indicate if the user has engaged in any specified domestic transaction in relation to electricity supply or transmission. Answer 'Yes' or 'No'.

- If the answer is 'Yes', fill in the details of the associated enterprises, including their name and address. Describe the specific eligible domestic transaction conducted.

- Include details about the relevant order of the Appropriate Commission, along with the amount that has been received or is payable in relation to the eligible transaction.

- Confirm if the transfer pricing complies with the circumstances outlined under the applicable rule.

- Finally, ensure that the declaration at the end of the form is complete, stating that all information provided is correct, and fill in the place, date, signature, and the name and designation of the user.

- Once all the information is filled in, users can save changes, download the completed form, print it for records, or share it as needed.

Start filling out your documents online today for a smooth submission process!

What is Form 3CEB, and what is its function? Ans: Anyone entering into international or specified domestic transactions covered under Section 92E needs to submit Form 3CEB. This is a report made by a Chartered Accountant after audits and contains details of value and other details of international transactions or SDT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.