Loading

Get Eitc Organization Guidelines 2015 F - Pa Department Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EITC Organization Guidelines 2015 F - PA Department Of online

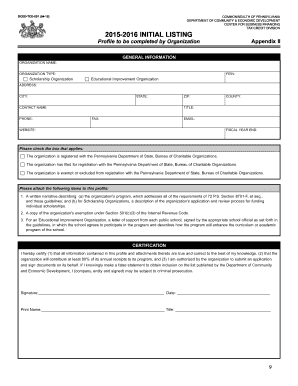

The Educational Improvement Tax Credit (EITC) Organization Guidelines 2015 F provides a framework for organizations seeking to secure tax credits for educational improvement in Pennsylvania. This user-friendly guide will assist you in accurately completing the necessary forms online, ensuring compliance with all relevant regulations.

Follow the steps to complete your EITC application effectively.

- Click ‘Get Form’ button to obtain the EITC Organization Guidelines 2015 F form and open it for editing.

- Begin filling out the general information section. Input your organization name, organization type (select either Scholarship Organization or Educational Improvement Organization), and Federal Employer Identification Number (FEIN). Include the address, city, state, ZIP code, and county.

- Provide contact information for the designated person within your organization, including their name, phone number, fax number, email, and website.

- Indicate your organization’s registration status with the Pennsylvania Department of State. Select the appropriate checkbox for registration status.

- Attach the required documents: a written narrative describing your organization’s program, proof of 501(c)(3) exemption, and letters of support from public schools if applicable.

- Review the certification section. Ensure you understand and agree to the statements provided, then sign and date the form.

- Submit the completed form and attachments according to the guidelines. Ensure to retain copies of all documents for your records.

- Confirm submission and track the application’s progress as indicated in the guidelines, awaiting notification from the Department within 60 days.

- If your application is approved, ensure to maintain accurate records and prepare for annual reporting requirements to remain compliant.

Start filling out your EITC Organization Guidelines form online today to secure your educational improvement tax credit!

The EITC is a credit available to employed, low-income households. It is intended to boost the effective income of people who are employed. The CTC is a credit available to employed households with children. This credit is intended to help offset the costs of raising children.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.