Loading

Get Individual Tax Forms City Of Kettering - Fill Out And Sign ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Individual Tax Forms City Of Kettering online

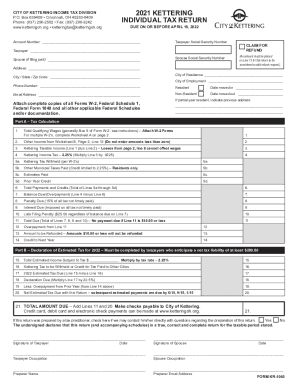

Filing your individual tax forms for the City of Kettering can be a straightforward process when you follow the right steps. This guide will provide clear instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out your tax forms correctly

- Click ‘Get Form’ button to obtain the form and open it in the designated tool for editing.

- Enter your taxpayer social security number in the specified field at the beginning of the form. Ensure accuracy to avoid issues with processing.

- Input your account number, tax payer name, and if applicable, the spouse's social security number and name if filing jointly.

- Fill in your address details, ensuring that your city, state, and zip code are correctly entered.

- Complete the claim for refund section, ensuring that an amount is placed on Line 13 for the refund request to be considered valid.

- Indicate your city of residence and city of employment in the appropriate fields.

- Provide your contact information, including phone number and email address, for any follow-up communications.

- Choose whether you are a resident or non-resident and provide the relevant dates and previous address if applicable.

- Move to Part A for tax calculation. Start with total qualifying wages and ensure to attach W-2 forms if required.

- Carefully follow the calculation steps in Part A, entering totals on the appropriate lines and proceeding to the next calculations for Kettering income tax, payments, and credits.

- Proceed to Part B if applicable, indicating your estimated taxes for the subsequent year, noting any necessary amounts.

- Complete the declaration of estimated tax and ensure all lines are filled according to the instructions provided.

- If this return was prepared by a tax practitioner, indicate if they can be contacted regarding the preparation.

- Finally, sign and date the form, ensuring all necessary signatures are obtained and any preparer information is filled in.

- Review your form for accuracy and completeness. Save changes, and be ready to download, print, or share the form as needed.

Complete your individual tax forms online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

What information will I need to fill in a Self Assessment tax return? your ten-digit Unique Taxpayer Reference (UTR) your National Insurance number. details of your untaxed income from the tax year, including income from self-employment, dividends and interest on shares. records of any expenses relating to self-employment.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.