Loading

Get Authorization Of Interest-only Payments - Tiaa-cref - Tiaacref

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authorization of Interest-Only Payments - TIAA-CREF online

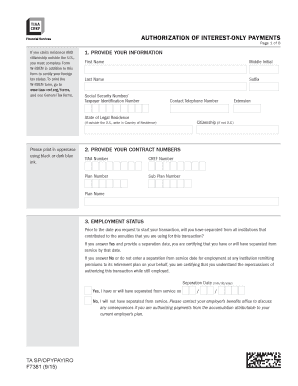

Filling out the Authorization of Interest-Only Payments form is an essential step for participants aged 55 to 69½ who wish to establish an Interest-Only Option contract with TIAA-CREF. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Authorization of Interest-Only Payments accurately.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Provide your personal information, including your first name, middle initial, last name, suffix, and Taxpayer Identification Number. Ensure that you print in uppercase using black or dark blue ink.

- Fill in your contact information, including your telephone number and state or country of legal residence.

- Enter your contract numbers for TIAA, CREF, and the applicable plan numbers.

- Indicate your employment status by answering whether you have separated from all institutions contributing to the annuities involved in this transaction and provide the separation date if applicable.

- Choose your payment start date and the amount for the Interest-Only Option. Specify whether you want to use your entire TIAA Traditional accumulation or a partial settlement, ensuring the minimum is at least $10,000.

- If performing a direct rollover to TIAA-CREF, provide the necessary account numbers and select the type of account.

- If rolling over to another company or plan, complete the detailed sections for that process and ensure the plan administrator completes their part.

- Specify payment instructions: choose direct deposit or mailing a check, and provide necessary banking information or documentation if selecting a new account.

- Review the authorization and signature section carefully. Sign and date your request in black or dark blue ink. Digital signatures are not accepted.

- Submit your completed form by selecting proper submission channels as indicated, either via fax, standard mail, or online upload.

Start completing your Authorization of Interest-Only Payments online today!

You can withdraw funds at any time. Log into TIAA.org, then use the SUPPORT menu to choose TRANSACTIONS & INFORMATION.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.