Loading

Get Comalad

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Comalad online

Filling out the Comalad, the supplemental application for 1-d-1 open space, can seem daunting at first. This guide will provide you with clear, step-by-step instructions to help you navigate the form effectively and confidently.

Follow the steps to complete your Comalad application online.

- Click the ‘Get Form’ button to obtain the Comalad document and open it in your preferred online editor.

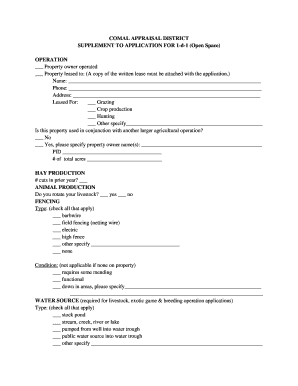

- Begin by indicating whether the property is owner-operated or leased. If it is leased, provide the name, phone number, and address of the lessee. Remember to attach a copy of the written lease with your application.

- Specify the purpose for which the property is leased by checking the appropriate box: grazing, crop production, hunting, or other. If you select 'other,' please provide a brief description.

- Answer the question regarding whether the property is used in conjunction with a larger agricultural operation. If 'yes,' include the property owner's name(s) and their PID (Property ID). Also, input the total number of acres for your property.

- For hay production, indicate the number of cuts made in the prior year.

- If you have livestock, indicate whether you rotate them by selecting 'yes' or 'no.'

- In the fencing section, check all applicable types of fencing you have on the property. If there is fencing, also describe its condition by selecting from the given options.

- For water source, check all types applicable to your property—such as stock pond, stream, or public water source. Make sure to provide specifics if you choose 'other.'

- Review all filled-out sections to ensure accuracy. Once complete, you can save your changes, download a copy, print the form, or share it as needed.

Complete your Comalad application online today and ensure your agricultural operation is accurately represented.

School taxes: All residence homestead owners are allowed a $25,000 homestead exemption from their home's value for school taxes. County taxes: If a county collects a special tax for farm-to-market roads or flood control, a residence homestead is allowed to receive a $3,000 exemption for this tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.