Loading

Get Form 510b - Imrf - Imrf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 510B - IMRF - Imrf online

Filling out the Form 510B - IMRF - Imrf online can be straightforward with the right guidance. This guide provides detailed instructions to assist you in correctly completing the form for rolling over your previously taxed contributions.

Follow the steps to successfully complete the Form 510B - IMRF - Imrf.

- Press the ‘Get Form’ button to obtain the form and open it for editing.

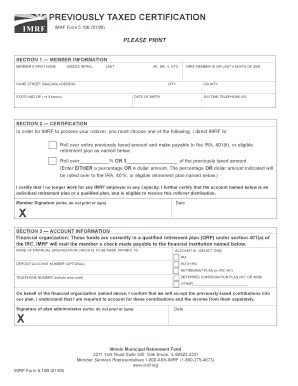

- In Section 1, enter your personal information clearly, including your first name, middle initial, last name, home address, IMRF member ID or last four digits of your Social Security number, city, state, zip code (plus four if known), date of birth, county, and daytime telephone number.

- Move to Section 2, where you need to specify how you would like your previously taxed contributions to be handled. If you want to roll over the entire amount, check the box marked 'all.' If you wish to roll over only a portion, input either a percentage or dollar amount in the provided space. Ensure you indicate where this amount will be rolled over, such as an IRA or other eligible retirement plan.

- In Section 2, also certify that you no longer work for any IMRF employer by signing your name and providing the date of your signature.

- Proceed to Section 3, which needs to be completed by a representative from your financial institution or the custodian of your account. They should fill in the name of the financial organization to whom the check should be made payable, and you may optionally provide a deposit account number.

- Ensure the plan administrator from the financial organization signs to confirm acceptance of the previously taxed contributions. This signature must be accompanied by the date.

- Before submitting, make a copy of the completed form for your records. Once you have verified all information, proceed to submit the form to IMRF through the designated method.

Complete your Form 510B - IMRF - Imrf online today for a smooth rollover process.

If you retire between age 55 and 60 with less than 30 years of service credit: your pension is reduced 1/4% for each month under age 60. − Under age 60 or − Of service credit less than 35 years. If you retire with 35 or more years of service credit and are at least age 55, there is no reduction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.