Loading

Get Irs Form W-8ben And Instructions - Citibank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

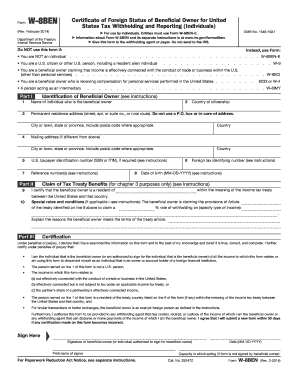

How to fill out the IRS Form W-8BEN And Instructions - Citibank online

Filling out the IRS Form W-8BEN is essential for foreign individuals who wish to document their status for U.S. tax purposes and claim any applicable benefits. This guide offers clear and supportive instructions for completing the form efficiently, ensuring users understand each step and its significance.

Follow the steps to complete the IRS Form W-8BEN online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name in Line 1. This should reflect the name of the individual who is the beneficial owner.

- For Line 2, provide your country of citizenship, including any relevant information if you hold dual citizenship.

- In Line 3, input your permanent residence address. Avoid using a P.O. box or in-care-of address.

- If your mailing address differs from your permanent residence, input it in Line 4.

- For Line 5, provide your U.S. taxpayer identification number if applicable, such as a Social Security Number or Individual Taxpayer Identification Number.

- In Line 6, if applicable, include your foreign tax identifying number.

- Enter your date of birth in Line 8 using the format MM-DD-YYYY.

- For Line 9, indicate your country of residence for tax treaty purposes.

- If claiming special tax treaty benefits, complete Line 10 with the relevant details.

- Review the Certification section (Part III) where you will declare your information's accuracy by signing and dating the form.

- Ensure the completed form is saved. You may then download, print, or share the form with the required withholding agent.

Complete your IRS Form W-8BEN online to document your foreign status and claim any available treaty benefits.

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.