Loading

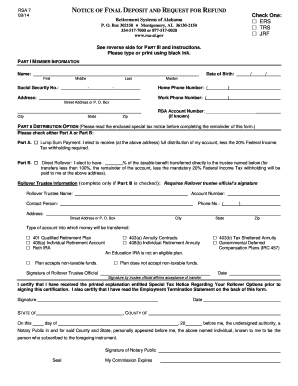

Get Rsa 7 Notice Of Final Deposit And Request For Refund - Retirement - Rsa-al

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RSA 7 Notice Of Final Deposit And Request For Refund - Retirement - Rsa-al online

Completing the RSA 7 Notice Of Final Deposit And Request For Refund form is an essential step in managing your retirement funds. This guide offers clear and comprehensive instructions to help you successfully fill out this form online, ensuring a smooth submission process.

Follow the steps to complete the RSA 7 form accurately.

- Press the ‘Get Form’ button to obtain the form and access it within your preferred document editor.

- In Part I, enter your personal information: your name (first, middle, last), date of birth, social security number, address (including city, state, and zip), and contact numbers (home and work). It is helpful to have these details prepared in advance.

- Proceed to Part II for the distribution option. Choose either Part A for a lump sum payment or Part B for a direct rollover. If selecting Part B, indicate the percentage to be transferred and complete the rollover trustee's information, including their signature, contact details, and the type of retirement account.

- Ensure that the rollover trustee official signs and dates the section to confirm the acceptance of the transfer.

- In the Notary section, you will need to have your signature notarized. This is required before submitting the form.

- Part III must be completed by your employing agency. Ensure they certify that your final salary payment has been processed and that there are no outstanding employment contracts.

- Review all sections of the form for completeness and accuracy. Once satisfied, finalize your form and prepare it for submission.

- After completing the form, you can save changes, download a copy for your records, print it out for submission, or share it as necessary.

Ensure that all forms and necessary documents are filled out correctly and submitted online for efficient processing.

A “section 457 plan” is a deferred compensation plan that is maintained by an eligible employer and that complies with the specific requirements set out in IRC Section 457(b).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.