Loading

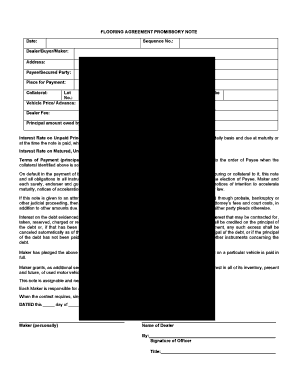

Get Flooring Agreement Promissory Note

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FLOORING AGREEMENT PROMISSORY NOTE online

Filling out a flooring agreement promissory note online can be a straightforward process if you follow each step methodically. This guide aims to provide clear instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your flooring agreement promissory note.

- Click ‘Get Form’ button to obtain the flooring agreement promissory note and open it in your preferred editing tool.

- Input the date in the designated section, ensuring it reflects the accurate day the document is being filled out.

- Enter the sequence number assigned to the agreement for tracking purposes.

- Fill in the names and addresses for the dealer/buyer/maker as well as the payee/secured party. Ensure all information is current and accurate.

- Specify the place for payment where the transactions will occur.

- List the collateral involved, including vehicle details such as lot number, vehicle price, and year.

- Record the VIN (Vehicle Identification Number) and make of the vehicle accurately.

- Specify the dealer fee and the principal amount owed by the maker on this note, ensuring it is the final agreed-upon figure.

- Indicate the interest rate on the unpaid principal, making sure it does not exceed the legal limit, and calculate the daily interest charge.

- Outline the terms of payment, including when the properties will be paid off and under what conditions.

- Review the provisions regarding default and collection, ensuring you understand the implications outlined within.

- Fill in the names where indicated and have the required individuals, such as the dealer's officer, sign the document.

- Once all fields are completed, save your changes, then download, print, or share the flooring agreement promissory note as needed.

Complete your flooring agreement promissory note online today for an efficient document management experience.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.