Loading

Get Filer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Filer Form online

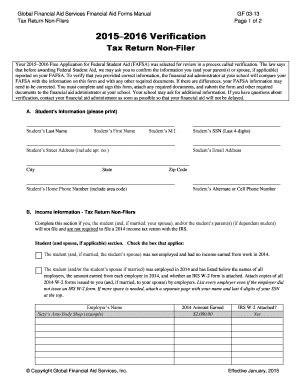

Filling out the Filer Form is a crucial step in the verification process for your financial aid application. This guide will provide you with clear, step-by-step instructions to help you complete the form online while ensuring accuracy and compliance with the requirements.

Follow the steps to successfully complete the Filer Form online.

- Click ‘Get Form’ button to obtain the Filer Form and open it in your preferred online editor.

- Begin by entering the student’s information in section A. Print the student’s last name, first name, middle initial, last four digits of their social security number, street address, email address, city, state, zip code, and home and alternate phone numbers.

- Move to section B, titled 'Income Information - Tax Return Non-Filers.' Here, select the applicable checkbox indicating whether the student (and spouse, if applicable) was employed or not in 2014. If employed, provide the names of all employers and the amount earned from each, along with the status of the IRS W-2 forms.

- If you are a dependent student, complete the parent section by checking the appropriate box and providing the same details for the parent(s) concerning their employment status and income in 2014.

- Once all sections are filled out, review the information for accuracy. Ensure all necessary attachments, such as IRS W-2 forms, are included as required.

- Proceed to the certification and signature section, where the student must sign and date the form. If applicable, obtain signatures from the spouse and parents as indicated.

- Finally, save your changes and choose to download, print, or share the completed Filer Form as needed for submission to the financial aid administrator at your school.

Now that you have your guide, start filling out your Filer Form online and ensure your financial aid application goes smoothly.

If you don't typically file a tax return and haven't received an Economic Impact Payment register soon using the Non-Filers: Enter Info Here tool on IRS.gov. This extension is only for those who haven't received their EIP and don't normally file a tax return. The IRS's Non-Filers tool is secure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.