Loading

Get Tr193 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tr193 1 online

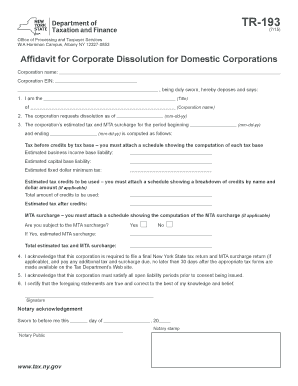

The Tr193 1 form, also known as the Affidavit for Corporate Dissolution for Domestic Corporations, is an essential document for corporations seeking to formally dissolve. This guide provides a clear, step-by-step approach to assist users in completing the form accurately online.

Follow the steps to complete the Tr193 1 form online:

- Press the ‘Get Form’ button to access the Tr193 1 form and open it in your preferred editor.

- Enter the corporation name in the designated field. This should be the full legal name of the corporation as registered.

- Input the corporation's Employer Identification Number (EIN) in the specified space. This number is crucial for identification purposes.

- In the title section, indicate the title of the person completing the form. This is typically a corporate officer.

- State the requested dissolution date using the mm-dd-yy format. Ensure the date is valid and correctly formatted.

- For the estimated tax and MTA surcharge, provide the period dates in mm-dd-yy format for both the start and end dates.

- Fill in the tax before credits by tax base. Attach a detailed schedule that shows how each tax base was computed.

- Complete the estimated business income base liability amount, followed by the estimated capital base liability.

- Enter the estimated fixed dollar minimum tax in the corresponding field.

- If applicable, attach a schedule detailing any estimated tax credits to be used, including breakdowns by name and dollar amount.

- Calculate the total amount of credits to be used and enter that value.

- Determine the estimated tax after credits and provide that figure in the relevant section.

- Indicate whether the corporation is subject to the MTA surcharge by selecting 'Yes' or 'No.' If yes, provide the estimated MTA surcharge amount.

- Calculate and enter the total estimated tax and MTA surcharge in the designated field.

- Review the statement acknowledging the requirement to file a final tax return and pay any due amounts. Ensure all information is correct.

- Sign the form to certify that the statements are true and correct as per your knowledge.

- Complete the notary acknowledgment section, including the date and notary stamp.

- Once all fields are completed, save your changes, and consider downloading, printing, or sharing the completed form as required.

Take the next step to complete your Tr193 1 form online and finalize your corporate dissolution.

Complete and file a Certificate of Surrender of Authority with the Department of State. The Certificate of Surrender of Authority requires the consent of the New York State Tax Commission. To request consent, call the New York State Tax Commission at (518) 485-2639.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.