Loading

Get Irs 886-a 1994-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 886-A online

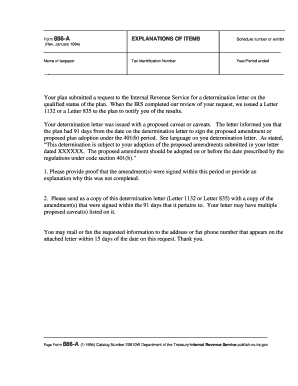

This guide provides step-by-step instructions for effectively completing the IRS 886-A form online. The IRS 886-A is essential for submitting necessary information regarding determinations related to retirement plans.

Follow the steps to successfully complete the IRS 886-A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the schedule number or exhibit as requested. This information helps identify the specific schedule associated with your request.

- Fill in the name of the taxpayer, ensuring accuracy to match the official records.

- Provide the tax identification number (TIN) associated with the taxpayer. This is crucial for identifying the taxpayer's account.

- Indicate the year or period ended relevant to your request. This helps specify the timeframe for your submission.

- Address any proposed amendments or caveats noted in your determination letter. Be prepared to provide proof of amendment signatures within the specified 91-day period.

- Attach a copy of the determination letter (Letter 1132 or Letter 835) along with signed amendments. Ensure that you have included any necessary documentation requested.

- Review all entries for correctness and completeness before finalizing your submissions.

- Once completed, you can save changes, download, print, or share the form as needed.

Complete your IRS 886-A form online today to ensure timely and accurate submission.

Eligibility for the IRS hardship program typically encompasses individuals who can provide satisfactory evidence of financial distress. This might include unexpected medical expenses, job loss, or other significant financial burdens. Leveraging services like USLegalForms could simplify the application process and enhance the clarity of your hardship claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.