Loading

Get Iowa Streamlined Sales Tax Return 32-025 - Iowa Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iowa Streamlined Sales Tax Return 32-025 - Iowa Department Of ... online

Filing your Iowa Streamlined Sales Tax Return 32-025 online can seem daunting, but this guide simplifies the process for you. Follow these step-by-step instructions to accurately complete the form and meet your tax obligations with confidence.

Follow the steps to successfully fill out your tax return.

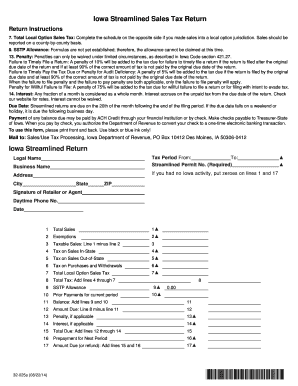

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in your business name, legal name, address, city, state, and ZIP code accurately. Ensure all information is current to avoid future issues.

- Indicate the tax period by entering the 'From' and 'To' dates that correspond to the sales period for which you are filing.

- Provide your Streamlined Permit Number, which is required to validate your tax return.

- If you had no sales activity in Iowa, enter zeroes on lines 1 and 17 as instructed.

- Calculate your total sales. Report the total sales amount on line 1.

- Declare any exemptions on line 2, utilizing the exemptions list provided. Include necessary details for each type of exemption.

- Determine taxable sales by subtracting the exemptions from the total sales, and enter the result on line 3.

- Calculate the tax on in-state sales and enter it on line 4.

- If applicable, report tax on out-of-state sales on line 5.

- Fill in tax on purchases and withdrawals on line 6.

- Complete the total local option sales tax calculations on line 7, entering any amounts due based on local jurisdictions.

- Add lines 4 through 7 to get your total tax, which should be entered on line 8.

- Consult section 9 regarding the SSTP allowance, keeping in mind it may not be claimed currently.

- Input any prior payments for the current period on line 10 and calculate the balance on line 11.

- Determine the amount due by subtracting line 11 from line 8 and entering it on line 12.

- If penalties apply, calculate and list them on lines 13 and 14, and add them to line 12 for the total due.

- Complete line 15 by adding lines 12 through 14 to finalize your total amount due.

- If you wish to make a prepayment for the next period, enter this on line 16.

- Finally, sum lines 15 and 16 to determine the total due or refund, entering the result on line 17.

- Save your changes, download, print, or share the completed form as necessary.

Complete your Iowa Streamlined Sales Tax Return online accurately and efficiently!

The state of Iowa became a full member of Streamlined Sales Tax on October 1, 2005.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.