Loading

Get Flexfacts Claim Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Flexfacts Claim Form online

Filling out the Flexfacts Claim Form online is a straightforward process designed to streamline your reimbursement claims. This guide will provide clear, step-by-step instructions to help you complete each section of the form accurately.

Follow the steps to fill out the Flexfacts Claim Form online

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

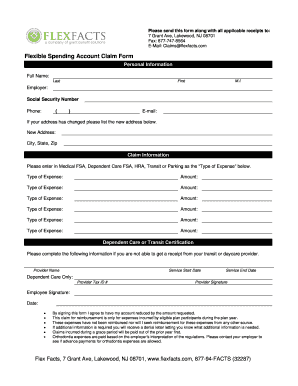

- Provide your personal information in the designated section. Enter your full name, including last name, first name, and middle initial. Include your employer’s name, Social Security number, phone number, and email address. If your address has changed, please update it in the provided fields for new address, city, state, and zip.

- In the claim information section, specify the type of expense you are claiming under Medical Flexible Spending Account (FSA), Dependent Care FSA, Health Reimbursement Arrangement (HRA), Transit, or Parking. For each type of expense, indicate the corresponding amount.

- If unable to obtain a receipt from your transit or daycare provider, complete the dependent care or transit certification section. Fill in the provider's name, service start date, and service end date. For dependent care only, include the provider’s tax ID number and require a signature from the provider.

- Sign the employee signature section and include the date. By signing, you agree to have your account reduced by the claimed amount and confirm that these expenses have not been reimbursed from any other source.

- After completing the form, review all entries for accuracy. Once confirmed, you can save your changes, download the completed form, or print it for submission.

Complete your Flexfacts Claim Form online today for a seamless reimbursement experience.

Allowed expenses include insurance copayments and deductibles, qualified prescription drugs, , and medical devices. You decide how much to put in an FSA, up to a limit set by your employer. You aren't taxed on this money.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.