Loading

Get Bare Bones Chapter 13 Filing

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bare Bones Chapter 13 Filing online

Filing for bankruptcy can be a daunting process, but understanding how to correctly complete the Bare Bones Chapter 13 Filing online will ease your journey. This guide provides clear, step-by-step instructions to help you through each section of the form.

Follow the steps to successfully file your Bare Bones Chapter 13 online

- Click ‘Get Form’ button to obtain the form and open it in your chosen online document editor.

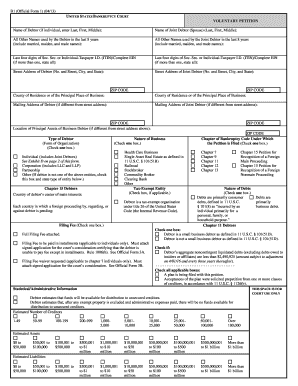

- Begin by filling out the Voluntary Petition, which is the first section of the Chapter 13 Filing. Include the name of the debtor, and if applicable, the joint debtor's name. Provide the last four digits of the Social Security Number or complete Employer Identification Number (EIN).

- Complete the mailing address and residential address fields for both the debtor and joint debtor, ensuring that all details are accurate including ZIP codes.

- Indicate the nature of your debts by checking the appropriate boxes. You will also need to select the type of debtor, checking the box that corresponds to whether you are an individual or a business entity.

- Fill out the section regarding the filing fee, checking the box for your chosen payment option, such as full payment or installments, and make sure to include the planned payment schedule if applicable.

- Next, complete the List of Creditors section, ensuring that you provide accurate names and addresses for all creditors involved in the case.

- Include the Statement of Social Security Number, making sure to provide the necessary information for both the debtor and any joint debtor.

- Finalize the form by reviewing all sections carefully. Ensure that you have signed all required pages and included any necessary attached exhibits.

- Once you complete the file, you can save your changes, download a copy for your records, print out the form, or share it as needed.

Begin your Bare Bones Chapter 13 filing online today and take the first step towards financial relief.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Chapter 13 Is Likely to Worsen Your Finances And once you're out of bankruptcy protection, you have more debt than ever. Since you now have paid the costs of bankruptcy - attorney fees and filing fees, a seven year flag on your credit report without receiving the main benefit of bankruptcy, a fresh start.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.