Loading

Get K Cns 010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the K Cns 010 online

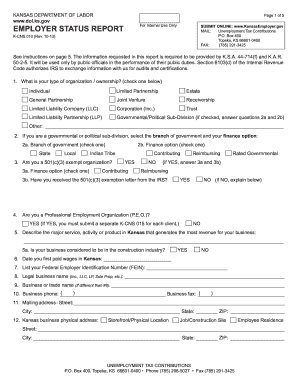

This guide provides step-by-step instructions for completing the K Cns 010, also known as the Employer Status Report. The aim is to simplify the process for users with varying levels of experience in digital document management.

Follow the steps to accurately complete the K Cns 010 online

- Press the ‘Get Form’ button to access the K Cns 010 form and open it for editing.

- Begin with section 1 by selecting the appropriate type of organization or ownership by placing an 'X' next to the relevant option.

- If a governmental or political sub-division is selected, indicate the branch of government and the finance option in sections 2a and 2b.

- For section 3, specify if you are a 501(c)(3) exempt organization and answer questions 3a and 3b accordingly.

- In section 4, indicate whether you are a Professional Employment Organization (P.E.O.). If ‘YES’, remember to submit a K-CNS 015 for each client.

- Provide a description of your major service, activity, or product that generates the most revenue in Kansas in section 5.

- Record the date you first paid wages in Kansas in section 6.

- Enter your Federal Employer Identification Number (FEIN) in section 7.

- Fill in your legal business name in section 8 and trade name in section 9 if applicable.

- Complete sections 10 and 11 by providing your business phone, business fax, and the mailing address.

- In section 12, specify your business's physical address in Kansas, accurately detailing the street, city, state, and ZIP code.

- Indicate where your accounting records are maintained in section 13, either providing the address or checking the box if it is the same as the previous address.

- Identify your payroll contact in section 14 by providing their name, phone number, email, and address.

- In section 15, enter the full legal names and addresses of owners, corporate officers, and any relevant identifiers, avoiding nicknames.

- Record all Kansas wages paid by calendar quarter in section 16 for the current and prior year.

- In section 17, indicate which week established your liability based on employment numbers.

- Respond to section 18 with details about acquiring a business, if applicable.

- List any multiple business locations you operated in Kansas for the last three years in section 19.

- Indicate your status regarding the Federal Unemployment Tax Act (FUTA) in section 20.

- Decide if you wish to elect for coverage in section 21 and mark your choice.

- Confirm if your business is continuing to pay wages in section 22.

- If applicable, detail any individuals performing services you believe are not employees in section 23.

- Indicate if you wish to have a KDOL representative contact you for further information in section 24.

- Finally, certify the accuracy of the information provided in section 25 by signing, entering your title, and noting the date.

- Once completed, save your changes, and prepare to download, print, or share the form as needed.

Start filling out the K Cns 010 online today, ensuring all required details are accurately provided.

The Kansas minimum wage is $7.25 per hour. All employees not covered by the Federal Fair Labor Standard Act must be paid Kansas minimum wage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.