Loading

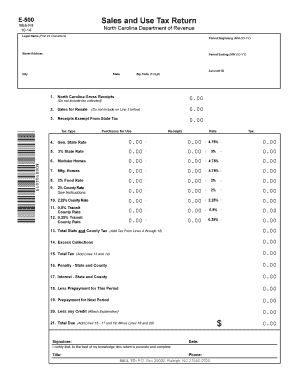

Get Sales And Use Tax Return - Department Of Revenue - Dor State Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sales And Use Tax Return - Department Of Revenue - Dor State Nc online

Managing your sales and use tax return can seem overwhelming, but with the right guidance, it can be a straightforward process. This guide provides step-by-step instructions to help you accurately fill out the Sales And Use Tax Return for the North Carolina Department of Revenue online.

Follow the steps to complete your tax return successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the period beginning and ending dates in MM-DD-YY format to specify the tax period for which you are filing. These dates are crucial for accurate tax calculations.

- Fill in your account ID, which is uniquely assigned to your business, ensuring that your return is properly linked to your tax account.

- Provide the legal name of your business, limited to the first 24 characters. This should align with the name registered with the North Carolina Department of Revenue.

- Input your business street address, city, state, and zip code (5-digit). This information ensures that correspondence reaches you effectively.

- Enter the date in the designated field, which indicates when you are submitting this return.

- Include your phone number, allowing the Department of Revenue to contact you if necessary for questions regarding your return.

- Sign the form to certify that, to the best of your knowledge, all information provided is accurate and complete. Include your title in the relevant field.

- Complete the tax receipt sections, ensuring you note gross receipts, exempt receipts, and sales for resale accurately. Calculate the respective taxes based on rates for state, county, and food.

- Calculate total taxes owed, including any penalties or interest. Make sure to add values from appropriate lines as indicated, and subtract any credits or prepayments.

- Review your entries for accuracy. Ensure that all numerical entries are correct before proceeding.

- Submit the completed form electronically by following the guidelines provided online. After submission, you can choose to save changes, download, print, or share a copy of your form.

Complete your sales and use tax return online with confidence today!

Filing a claim for refund using Form E-588, Business Claim for Refund State, County and Transit Sales and Use Taxes. The claim must identify the taxpayer, the type and amount of tax overpaid, the filing period to which the overpayment applies, and the basis for the claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.