Loading

Get Change Of Resident Status If You Are Married And Filing Separate New York State Returns

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Change Of Resident Status If You Are Married And Filing Separate New York State Returns online

Navigating tax forms can be challenging, especially when changing your resident status. This guide will provide clear and supportive instructions on filling out the Change of Resident Status form for individuals who are married and filing separate New York State returns online.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to begin the process of obtaining the Change of Resident Status form. This action will allow you to access the necessary document to continue.

- Begin filling out the form by entering the name(s) as shown on your return. Ensure that your names match the documentation you are submitting.

- Next, provide the social security number for yourself and your partner. This section is crucial for the identification and processing of your form.

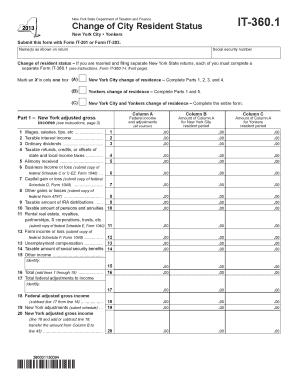

- Indicate the change of resident status by marking an 'X' in one of the boxes (A for New York City, B for Yonkers, or C for both). Choose the option that accurately reflects your situation.

- Complete Part 1 by reporting your New York adjusted gross income. Fill in the amounts for various sources of income, such as wages, taxable interest, and business income, in the relevant columns.

- If you are claiming itemized deductions, proceed to Part 2. List all applicable deductions in the spaces provided, ensuring to follow guidance from the accompanying instructions.

- In Part 3, enter the dependent exemptions. Fill in the period that you were a resident, and provide the required details about dependents.

- Complete Part 4 if applicable, to calculate your part-year New York City resident tax based on your adjusted gross income and itemized deductions.

- If applicable, proceed to Part 5 to calculate the part-year Yonkers resident income tax surcharge. Carefully follow the instructions provided for this section.

- Finally, review all entered information for accuracy. Once completed, you may save changes, download, print, or share the form as needed.

Take the next step and complete your documents online today!

So filing separately is a good idea from a tax savings standpoint only when one spouse's deductions are large enough to make up for the second spouse's lost deduction amount. Filing separately even though you are married may be better for your unique financial situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.