Loading

Get Claim For Reassessment Exclusion For Transfer Between Parent And Child

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Claim For Reassessment Exclusion For Transfer Between Parent And Child online

This guide provides clear, step-by-step instructions on completing the Claim For Reassessment Exclusion For Transfer Between Parent And Child online. It is designed to assist users, regardless of their prior experience with legal documents.

Follow the steps to comprehensively fill out the form.

- Press the ‘Get Form’ button to access the Claim For Reassessment Exclusion For Transfer Between Parent And Child form.

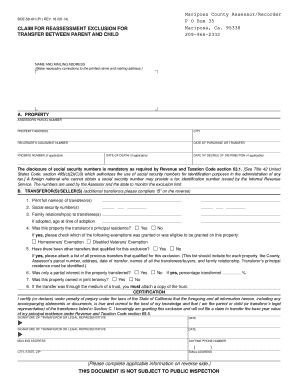

- In Section A, fill out the property details including the assessor's parcel number, property address, city, recorder's document number, date of purchase or transfer, and applicable probate information. Ensure all entries are accurate.

- Complete the transferor(s) information in Section B. Print the full names of all transferors, their social security numbers, and clarify the family relationships to the transferees. Indicate if the property was the principal residence and check any exemptions that apply.

- If applicable, attach a list of any previous transfers that qualified for this exclusion. Mention whether a partial interest in the property was transferred and, if owned jointly, specify the percentage that was transferred.

- In the certification section, read the declaration carefully then proceed to sign and date the form as the transferor or their legal representative. Fill in your mailing address and daytime phone number.

- Proceed to Section C, entering details for the transferee(s). Provide their full names and clarify any relationships to the transferors. If additional transferees need to be listed, follow the same format as in Section B.

- Ensure both the transferor(s) and transferee(s) sign and date the certification, confirming that all information is true to the best of their knowledge.

- Review all sections of the form for completeness, then save your changes or download the filled document. You can also print or share the filled form as needed.

Complete your claim form online to initiate the reassessment exclusion process.

Passed by voters in 1978, Proposition 13 lowered property taxes to 1% (from 2.67%) of the full value of the property. ... Yet when the transfer occurs between a parent and a child, the child can inherit the low Proposition 13 tax basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.