Loading

Get Ar4506 Request For Copies Of Arkansas Tax Return(s) - Dfa Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the AR4506 Request For Copies Of Arkansas Tax Return(s) - Dfa Arkansas online

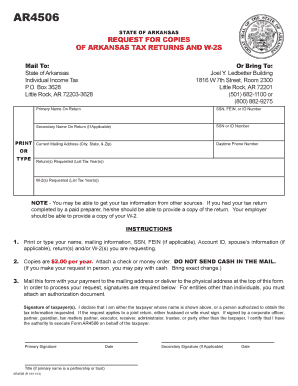

Filling out the AR4506 Request For Copies Of Arkansas Tax Return(s) allows you to obtain copies of your previous tax returns and W-2 forms from the state of Arkansas. This guide provides clear instructions for completing the form online, ensuring a smooth process.

Follow the steps to accurately complete the AR4506 form online.

- Press the ‘Get Form’ button to access the AR4506 form and open it in your preferred editing tool.

- In the first section, provide the primary name as it appears on the tax return, alongside the social security number (SSN), federal employer identification number (FEIN), or identification number associated with the return.

- If applicable, fill out the secondary name on the return and include their SSN or ID number.

- Enter your current mailing address, including city, state, and zip code, ensuring that it is accurate for future correspondence.

- Provide a daytime phone number where you can easily be reached for any clarifications related to your request.

- List the tax years for which you are requesting copies of the returns in the designated section.

- If you need copies of W-2 forms, specify the tax years in the corresponding section.

- Sign and date the form as the taxpayer. If the request applies to a joint return, ensure that both partners sign. If you are signing on behalf of another individual or entity, verify that you have the necessary authority.

- Attach a check or money order for the processing fee of $2.00 per requested year. Avoid sending cash through the mail.

- Mail the completed form along with your payment to the provided mailing address, or deliver it in person to the specified physical address.

- After submitting your request, be on the lookout for follow-up communications regarding the status of your request and any additional information needed.

Complete and submit your AR4506 form online today to ensure you receive your tax documents promptly.

You also may check the status of your refund by calling +1 (501) 682-1100 or toll free at +(800) 882-9275.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.