Loading

Get Form St-mab-4 - Mass.gov - Mass

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-MAB-4 - Mass.Gov - Mass online

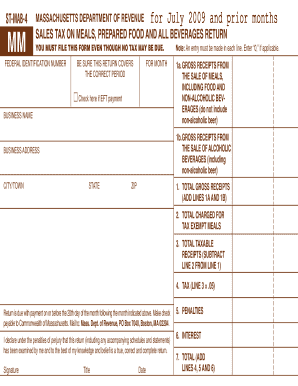

Filling out the Form ST-MAB-4 is essential for reporting sales tax on meals, prepared food, and beverages in Massachusetts. This guide provides clear, user-friendly instructions to help you accurately complete the form online.

Follow the steps to successfully fill out and submit your form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter your federal identification number in the designated field at the top of the form.

- Ensure to select the correct reporting period by indicating the month for which you are filing the return.

- In the ‘Business Name’ section, write the name of the business or establishment for which you are filing the form.

- Complete the ‘Business Address’ section with the full address, including city/town, state, and ZIP code.

- Fill out lines 1a and 1b with the gross receipts from the sale of meals (including non-alcoholic beverages) and the sale of alcoholic beverages, respectively. If there are no sales in these categories, enter '0'.

- Calculate the total gross receipts by adding the amounts from lines 1a and 1b; enter this value in line 1.

- Enter the total amount charged for tax-exempt meals on line 2.

- Calculate the total taxable receipts by subtracting line 2 from line 1, and enter this value on line 3.

- Compute the tax owed by multiplying the amount in line 3 by 0.05, and write this figure on line 4.

- If applicable, complete lines 5 and 6 for penalties and interest, and then sum these values in line 7.

- Review all information for accuracy. Once satisfied, you may save changes, download, print, or share the completed form as needed.

Complete your Form ST-MAB-4 online today to ensure timely filing and compliance with Massachusetts tax regulations.

Related links form

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. ... Generally, food products people commonly think of as groceries are exempt from the sales tax, except if they're sold as a meal from a restaurant part of a store.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.