Loading

Get Exempt Bus Operator Diesel Fuel Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exempt Bus Operator Diesel Fuel Tax Return online

Completing the Exempt Bus Operator Diesel Fuel Tax Return online is essential for reporting your diesel fuel transactions accurately. This guide will provide you with clear, step-by-step instructions to navigate the various sections of the form effectively.

Follow the steps to complete your tax return with ease.

- Click ‘Get Form’ button to access the Exempt Bus Operator Diesel Fuel Tax Return and open it in the editor.

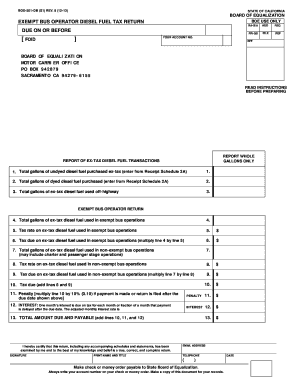

- Start with the Report of Ex-Tax Diesel Fuel Transactions section. Enter the total gallons of undyed diesel fuel purchased ex-tax from your Receipt Schedule 2A on line 1.

- For line 2, enter the total gallons of dyed diesel fuel purchased, again from Receipt Schedule 2A.

- On line 3, report the total gallons of ex-tax diesel fuel you have used off-highway.

- In the Exempt Bus Operator Return section, enter the total gallons of ex-tax diesel fuel utilized in exempt bus operations on line 4.

- Fill in the current tax rate applicable to ex-tax diesel fuel used in exempt bus operations on line 5.

- Calculate the tax due on line 6 by multiplying the value on line 4 by the tax rate from line 5, and enter the result.

- Proceed to line 7 and enter the total gallons of ex-tax diesel fuel used in non-exempt bus operations.

- Enter the applicable tax rate for non-exempt operations on line 8.

- Calculate the tax due for non-exempt operations by multiplying the gallons from line 7 by the tax rate from line 8, and enter this value on line 9.

- Add the tax amounts from lines 6 and 9 to determine the total tax due, which you will enter on line 10.

- If applicable, compute any penalty for late payment on line 11, which is 10% of the amount on line 10.

- For line 12, calculate any interest on overdue payments based on the interest rate specified on the return.

- Finally, sum lines 10, 11, and 12 to get the total amount due on line 13.

- Complete the certification section by signing the form, and providing your email address and telephone number along with your printed name and title.

- Once you have filled out the form, you can save changes, download, print, or share the form as needed.

Complete your Exempt Bus Operator Diesel Fuel Tax Return online today.

The Fuel Tax Credit allows businesses to reduce their taxable income dollar for dollar based on using specific types of fuel costs. This credit is only available to some individuals, as it is limited to off-highway business use and a strictly defined selection of uses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.