Get Boe 267 Snt P1 Rev17 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Boe 267 Snt P1 Rev17 Form online

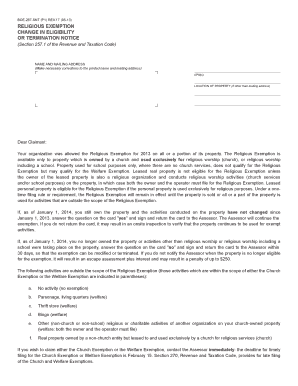

The Boe 267 Snt P1 Rev17 Form is essential for organizations claiming a religious exemption. This guide will provide you with a clear, step-by-step process to complete the form online, ensuring you submit accurate information to maintain your exemption status.

Follow the steps to effectively complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Review the top of the form for the sections labeled name and mailing address. Correct any printed errors to ensure accurate identification of your organization.

- In the APN(s) section, provide the Assessor's Parcel Number(s) assigned to the property in question. This information is vital for clarity on which properties the exemption applies.

- Fill in the location of the property if it differs from the mailing address provided. Accurate location details help the Assessor verify your claim.

- Answer the question regarding whether the property will continue to be used exclusively for religious purposes in the upcoming fiscal year. Select 'Yes' or 'No' based on your situation.

- Sign and date the form to authenticate your claims. Ensure to include your title, telephone number, and an optional email address for further communication.

- After completing all necessary sections, review your entries for accuracy. Once confirmed, save the changes, and choose to download, print, or share the completed form as needed.

Get started with filling out the Boe 267 Snt P1 Rev17 Form online today!

Homeowners exemption for seniors aged 55 and older For homeowners over the age of 55 in California, Prop 19 allows them to transfer the taxable value of their primary residence to a newly purchased or constructed replacement residence of any value, anywhere in the state. What California Prop 19 Could Mean for Seniors and Their Heirs - Corient corient.com https://corient.com › california-proposition-19-explained corient.com https://corient.com › california-proposition-19-explained

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.