Loading

Get Cost Basis Calculation Form From Spin-off - Pactiv

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cost Basis Calculation Form From Spin-off - Pactiv online

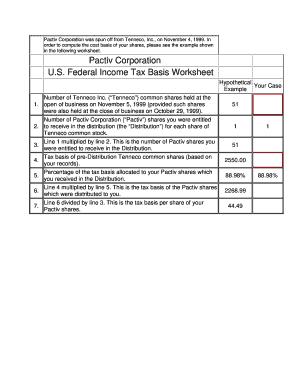

This guide provides a clear and supportive walkthrough on how to fill out the Cost Basis Calculation Form From Spin-off - Pactiv online. Understanding the process will help you accurately calculate the tax basis of your shares following the spin-off of Pactiv Corporation.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the number of Tenneco Inc. common shares you held at the start of business on November 5, 1999. Ensure these shares were also held at the close of business on October 29, 1999.

- Input the number of Pactiv Corporation shares you were entitled to receive in the distribution for each share of Tenneco common stock.

- Calculate the total number of Pactiv shares you were entitled to receive in the distribution by multiplying the number from step 1 by the number from step 2.

- Record the tax basis of your pre-distribution Tenneco common shares based on your personal records.

- Indicate the percentage of the tax basis that you are allocating to your Pactiv shares, which you received in the distribution.

- Determine the tax basis of the Pactiv shares distributed to you by multiplying the amount from step 4 by the percentage in step 6.

- Finally, calculate the tax basis per share of your Pactiv shares by dividing the amount from step 7 by the total number of shares from step 4. Once completed, you can save changes, download, print, or share the form.

Complete your Cost Basis Calculation Form online today to ensure your tax records are accurate.

How does the shareholder determine cost basis for a spin-off? Generally, the parent company will determine the percentage of the shareholder's cost basis in the parent company that should be allocated to the new spin-off company. This information can usually be found at the parent company's website.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.