Loading

Get Tc 69c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 69c online

This guide provides a straightforward approach to filling out the Tc 69c online. With clear instructions tailored for individuals with varying levels of experience, you'll be able to navigate the process smoothly.

Follow the steps to complete your Tc 69c online application.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editor for completion.

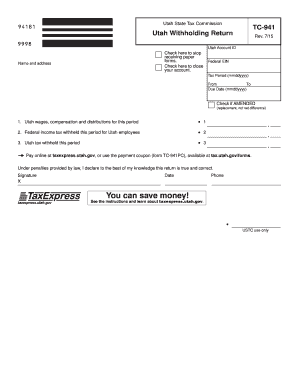

- Begin by entering your Utah Account ID and Federal Employer Identification Number (EIN) in the designated fields. Ensure these numbers are accurate as they are key to your tax records.

- Indicate the tax period by filling in the 'From' and 'To' dates in the format mmddyyyy. Make sure to correctly denote the period you are reporting.

- If applicable, check the box for 'Amended' to indicate that this form is a correction to a previously submitted return.

- Complete each field in accordance with the corresponding line instructions. Provide your name and address, ensuring they are current and correct.

- In Line 1, enter total Utah wages and compensation paid during the reporting period. Include all applicable payments to employees.

- In Line 2, input the total amount of federal income tax withheld for any employees listed in Line 1.

- For Line 3, enter the total Utah tax withheld for this period based on the data you provided in Line 1.

- After completing all sections, review your entries for accuracy and completeness.

- You can now save changes, download, print, or share the completed form as needed based on the options available.

Complete your Tc 69c document online with confidence today.

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.