Loading

Get Et 85

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Et 85 online

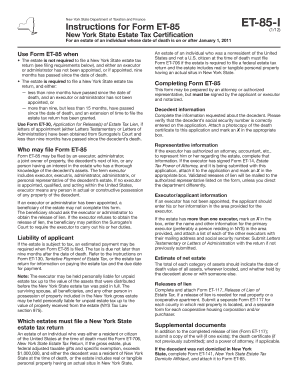

Filling out the Et 85 form online is an essential step for managing estate tax certification in New York State. This guide provides clear and detailed instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the Et 85 form online.

- Click the ‘Get Form’ button to access the Et 85 form and open it in your editor.

- Begin by completing the decedent information section. Ensure that all details, including the social security number, are correct. Remember to attach a photocopy of the death certificate and mark the appropriate box.

- In the representative information section, fill out the details of any authorized representative, such as an attorney or accountant. If a Form ET-14, Estate Tax Power of Attorney, is part of this application, attach it and mark the specified box.

- For the executor/applicant information, include your details if no executor has been appointed. If there are multiple executors, provide the main executor's information and attach a list of additional executors with their addresses and social security numbers.

- Next, detail the estimate of net estate by listing all assets' value as of the date of death, specifying if they were held solely by the decedent or jointly.

- If a release of lien is necessary, complete and attach Form ET-117 for each property involved, as well as any supplemental documents, such as the will or power of attorney, if applicable.

- Once all sections are filled out, review your information for accuracy. Save your changes, download the form, and prepare it for printing or sharing as needed.

Start completing the Et 85 form online today to ensure timely estate tax management.

file with the Tax Department: Form ET-706, New York State Estate Tax Return—using the return designated for the decedent's date of death—and. federal Form 706, United States Estate Tax Return— even if the estate is not required to file a federal estate tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.