Loading

Get Interstate User Diesel Fuel Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Interstate User Diesel Fuel Tax Return online

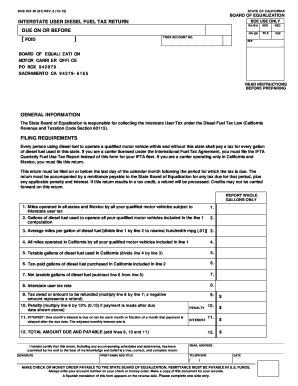

Filling out the Interstate User Diesel Fuel Tax Return is essential for anyone using diesel fuel to operate qualified motor vehicles across state lines. This guide provides step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete your tax return accurately

- Press the 'Get Form' button to access the Interstate User Diesel Fuel Tax Return form and open it for completion.

- Begin by filling in the required general information, including your account number and contact details. Ensure accuracy to avoid processing delays.

- For line 1, enter all miles operated in all states and Mexico by your qualified motor vehicles that are subject to interstate user tax. This should include both loaded and deadhead miles.

- On line 2, input the total gallons of diesel fuel used for the qualified motor vehicles included in your mileage calculation from line 1.

- Calculate the average miles per gallon by dividing the value from line 1 by the value from line 2. Record this number on line 3, extending it to the nearest hundredth (e.g., 4.21 mpg).

- For line 4, enter the total miles operated in California by the qualified motor vehicles included in line 1. This figure should encompass all applicable miles within the state.

- Calculate the taxable gallons of diesel fuel used in California by dividing the value on line 4 by the average miles per gallon noted on line 3. Document this on line 5.

- On line 6, state the total number of tax-paid gallons of diesel fuel that were purchased in California and used in the vehicles noted in line 2.

- Subtract the number on line 6 from line 5 and input the result on line 7. If this is a positive number, you will owe tax. If negative, you may qualify for a refund.

- Refer to line 8 to enter the current interstate user tax rate applicable to diesel fuel per gallon.

- On line 9, multiply the net taxable gallons from line 7 by the tax rate from line 8. This amount will indicate your tax owed or amount eligible for a refund.

- If applicable, complete lines 10 and 11 for any penalties and interest if your payment is late, using the guidelines provided.

- Finally, add lines 9, 10, and 11 to determine the total amount due, which should be entered on line 12.

- After reviewing all entered information for accuracy, save your changes. You can download, print, or share the completed form as needed.

Complete your Interstate User Diesel Fuel Tax Return online today to ensure compliance and avoid penalties.

The jurisdictions listed below are not IFTA members and IFTA credentials are not valid for travel there: United States: Alaska, Hawaii and the District of Columbia. Canada: Northwest Territories, Nunavit and Yukon Territory. Mexico: All states and the Federal District.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.