Loading

Get Instructions For Form D-1065 - Detroitmi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the instructions for form D-1065 - Detroitmi online

Filling out the Instructions for Form D-1065 for the City of Detroit can seem daunting, but this guide will break down each section to help you complete it with ease. Whether you are a seasoned filer or new to the process, this comprehensive guide will provide the clarity and support you need.

Follow the steps to successfully complete the form D-1065 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

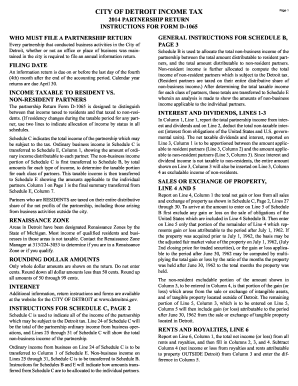

- Review the filing requirements. Ensure that your partnership is required to file an annual information return if it has conducted business activities in Detroit.

- Determine the filing date. If your partnership follows a calendar year accounting period, your return is due on or before April 30.

- Identify your partners' residency status, distinguishing between income taxed to residents and non-residents. Use two lines to document changes in residency for any partner during the taxable period as necessary.

- Complete Schedule C, which indicates the total income of the partnership. Ensure that ordinary business income is transferred to Schedule E, Column 1.

- Fill out Schedule B to allocate total non-business income between resident and non-resident partners. Understand the specific allocations as specified in the provided instructions.

- Populate Schedule E to distribute ordinary and non-business income to individual partners. Pay careful attention to the columns that require different percentages for resident and non-resident partners.

- Ensure all amounts are entered in whole dollars, rounding as instructed: round down for amounts less than 50 cents and round up for amounts between 50 and 99 cents.

- Review all filled sections for accuracy and completeness. Ensure that the totals from Schedules B and C match the amounts reported in Schedule E.

- Once all fields are completed, you can choose to save changes, download the form, print it, or share it as necessary.

Take the next step and complete your form D-1065 online for efficient processing.

If your AGI is less than your personal exemption allowance and City income tax was withheld from your earnings, you must file a return to claim a refund of the tax withheld. Nonresident/Part-Year: File a return if you owe tax, are due a refund, or your wages exceed your exemption allowance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.