Loading

Get Assessment Appeal Application - County Of San Diego

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Assessment Appeal Application - County Of San Diego online

This guide provides clear and comprehensive instructions for users to successfully complete the Assessment Appeal Application for the County of San Diego online. By following these steps, individuals will be well-equipped to submit their appeals accurately and efficiently.

Follow the steps to fill out the application accurately.

- Click ‘Get Form’ button to access the Assessment Appeal Application and open it in the designated editor.

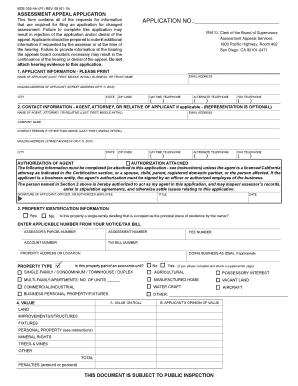

- Begin by entering your information in Section 1: Applicant Information. Provide your name, mailing address, email, and phone numbers as they appear on your tax records. Ensure that all details are accurate to prevent any delays in processing.

- Complete Section 2: Contact Information, if applicable. If you are using an agent, attorney, or relative, fill in their details. If the individual is not a California-licensed attorney or a close relative, ensure to attach the necessary authorization.

- In Section 3: Property Identification Information, identify the specific property by entering the assessor’s parcel number and assessment number from your tax documents. Include the property address and type.

- Move to Section 4: Value. In Column A, enter the values shown on your assessment notice. For Column B, provide your opinion of value for each applicable category. Remember that omitting your opinion may lead to application rejection.

- Select the appropriate option in Section 5: Type of Assessment Being Appealed. Check only one item that correctly describes your appeal's nature, following the provided guidelines regarding filing periods.

- In Section 6: Reason for Filing Appeal, indicate your reasons by checking the appropriate boxes. If unsure, select 'I. Other' and provide a brief explanation. This section is critical for justifying your appeal.

- Complete Section 7 regarding written findings of facts, specifying whether you are requesting them or not.

- In Section 8, indicate if you wish to designate the application as a claim for refund by checking the appropriate box.

- Finally, review the completed application for accuracy. Once confirmed, save your changes, print, or download it to retain a copy for your records before submission.

Take the first step today and fill out your Assessment Appeal Application online to ensure your voice is heard.

The local Recorder's Office (or County Clerk) records all property deeds of ownership, property transfers, and related legal documents. Some California counties call it the Registrar of Deeds office. These offices maintain up to date property records. This includes the current property owner's name.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.