Loading

Get Utah Tc 546

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Utah Tc 546 online

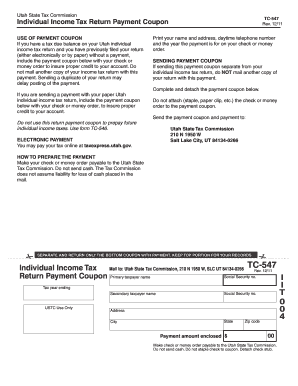

This guide provides a clear and comprehensive walkthrough for completing the Utah Tc 546 online. Whether you are filing for the first time or need a refresher, this resource will help you navigate the necessary steps with ease.

Follow the steps to successfully complete your Utah Tc 546 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your primary taxpayer information, including your name and Social Security number. Ensure that the information is accurate to avoid any issues with your filing.

- Next, fill in the tax year you are reporting on. This is crucial for the proper processing of your payment.

- Provide your address details, including city, state, and zip code. This information will be used for tax records and communications.

- Specify the payment amount you are enclosing. Double-check the figure for accuracy.

- Make your check or money order payable to the Utah State Tax Commission, and remember not to send cash.

- Do not staple the check or money order to the payment coupon; instead, detach the coupon and keep the top portion for your records.

- Once all information is complete, review the form for accuracy. After ensuring everything is correct, save changes, download, print, or share the form as needed.

Take the next step in managing your taxes — fill out your documents online now!

8, 2023. The Utah Legislature has approved a $400 million tax cut package, more than half of which, $208 million, will go toward dropping Utah's income tax rate from 4.85% to 4.65%. The House and Senate both voted Thursday to pass HB54, the bill containing the entire tax reduction package.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.