Loading

Get Rebate Form.xls - Dfa Arkansas

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rebate Form.xls - Dfa Arkansas online

Filling out the Rebate Form.xls - Dfa Arkansas is an essential step for individuals seeking to claim local tax rebates. This guide will provide you with clear and efficient instructions to complete the form online with ease.

Follow the steps to successfully complete your rebate form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your business name in the designated field at the top of the form. Ensure that the name is spelled correctly, as it should reflect your registered business name.

- Fill in your permit number in the specified section. This number is crucial for identifying your business within the local tax system.

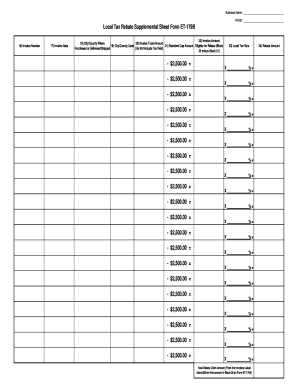

- Proceed to the Local Tax Rebate Supplemental Sheet. Start by entering the invoice number for each transaction you are claiming. Ensure that the invoice numbers are unique and correspond to the correct transactions.

- For each invoice, input the invoice date. This information should align with the dates on your original invoices to maintain accuracy.

- Complete the invoice amount field for each corresponding invoice. This amount should reflect the total cost before tax.

- Identify the city or county where the services were provided or where the goods were delivered. This helps local authorities verify your claims.

- Enter the city or county code associated with the location listed in the previous step. This code can usually be found through local tax resources.

- Fill out the invoice total amount that includes all costs associated with the invoice. Make sure this figure is correct and matches your invoices.

- Complete the standard cap amount eligible for rebate, derived by subtracting the city's taxable amount (Block 21) from the total of Block 20.

- Input the local tax rate applicable to each invoice. Ensure that you are using the correct percentage as per your locality's tax guidelines.

- Calculate the total rebate claim amount based on the invoices listed above. This total will be necessary for the next form (ET-179A) and should be accurate.

- Finally, review all sections to ensure that all information is accurate and complete. Save your changes, and then choose to download, print, or share the form as needed.

Start filling out your rebate form online today to ensure you receive your eligible tax credits.

Arkansas does not require registration with the state for a resale certificate. How can you get a resale certificate in Arkansas? To get a resale certificate in Arkansas, you may either fill out the Arkansas Exemption Certificate (Form ST 391) or the Streamlined Exemption Certificate Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.